Growing demand for flexible office space is expected to spread beyond Europe's core markets as the sector matures, according to research by Savills.

Take-up increased by 20% last year across 20 cities surveyed by Savills together with online specialist broker Workthere, to 830,000 m2. The total share of new office space was 9.9%, compared to 3% three years ago.

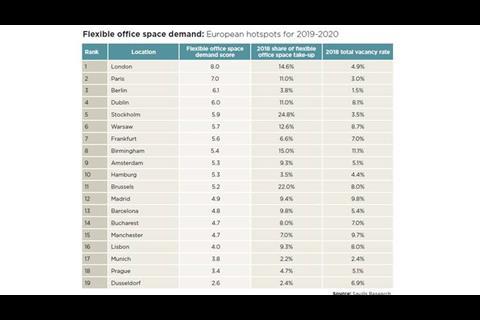

The highest concentration is in Stockholm, where 24.8% of all office space is flexible, followed by Brussels with 22% and London's West End on 21%.

However, while 80% of venture capital was invested in Paris, London and Berlin, Savills said the strongest growth in the near future was likely to be in smaller capitals such as Dublin and Warsaw, as well as secondary cities like Hamburg and Birmingham.

Flexible space now makes up 15% of office stock in Birmingham, 12.6% in Warsaw and 11% in Dublin, while the researchers also see growth potential in Amsterdam (9.3%), Frankfurt (6.6%) and Hamburg (3.5%).

Eri Mitsostergiou, research director at Savills, says: 'As part of our research, we have identified the cities where we expect future demand to be strongest based on a set of criteria related to economic growth, job creation, innovation, and property market fundamentals.

'As take-up of flexible offices continues to grow, it’s the smaller "second cities" where availability is higher and therefore where we can expect to see most growth.'

Cal Lee, global head and founder of Workthere, added: 'We believe that cities with dynamic economies, which attract innovation and talent can see demand for flexible offices rise up to 15% of the total in the medium term, while in the long term this could increase to 20-25%, especially in periods of economic growth and business investment.'