A joint venture between Revcap Advisors and Unifore Real Estate has acquired a Dutch office portfolio from Aventicum Real Estate.

Financial details were not disclosed.

The portfolio, known as Project Hawk, was divested on behalf of a real estate investment fund that Aventicum manages.

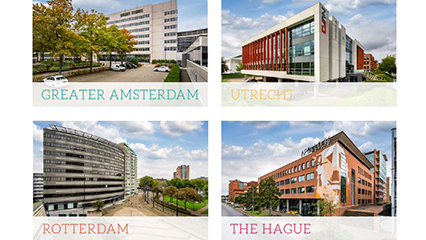

The assets include 12 office properties covering 70,000 m2 of institutional grade real estate, centred in and around Netherlands’ G4 cities and includes five assets in Utrecht, three in The Hague, one in Rotterdam and three in the Amsterdam region.

Aventicum Real Estate is a real estate investment management platform, affiliated with Credit Suisse and the Qatar Investment Authority. Since Aventicum’s first acquisition in 2017 and in collaboration with asset manager Cairn Real Estate, Aventicum has actively managed the assets to an occupancy rate of more than 90% and a weighted average lease term in excess of five years.

Revcap and Unifore will seek to continue to build on the strong fundamentals of the assets and further improve the ESG footprint of the portfolio.

Revcap is a London based leading European investor that targets the small and medium sized real estate markets in carefully aligned joint ventures with local operating partners like Unifore. Since inception, Revcap has transacted over £10bn of real estate across nearly 500 transactions.

Unifore is a specialised Dutch real estate investment and asset management company with about €800+ mln in assets under management.

JLL, Dentons, Deloitte and SGS advised Aventicum during the transaction. Revcap and Unifore were advised by Colliers, DLA, Greenberg Traurig, CFP and EY.