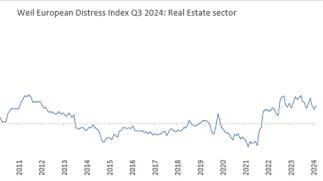

Real estate companies continue to display the highest levels of distress compared to other business sectors, according to the latest European Distress Index from global law firm Weil.

Although its distress levels eased slightly in Q3 compared to the previous quarter and year, the real estate sector remains the most challenged overall, with heavily leveraged companies facing refinancing pressures amid a high rate environment, the research found.

The Weil European Distress Index is constructed using data from over 3,750 listed European companies and a range of financial market indicators. Weil defines corporate distress as uncertainty about the fundamental value of financial assets, volatility and increases in perceived risk.

Among other key findings for Q3, industrials jumped from fourth to second most distressed sector, while Germany remained the most impacted geography, with distress reaching the highest level since the pandemic.

UK distress also rose to a 12-month-high, driven higher by declining investment, profitability and squeezed liquidity.

Weil said: ‘It remains a mixed picture across Europe, with a growing disparity between winners and losers across the continent. While sectors like real estate and industrials are facing significant pressures from rising costs and reduced investment, markets like Spain and Italy are showing resilience.’

‘However’, it added, ‘the coming months will be pivotal, with the US election, Germany’s ongoing electoral process, and the UK's Autumn Budget all likely to introduce further volatility. Businesses will need to prepare for potential shifts in trade policies, fiscal tightening, and market uncertainty, which could further widen the gap between resilient and distressed sectors.’