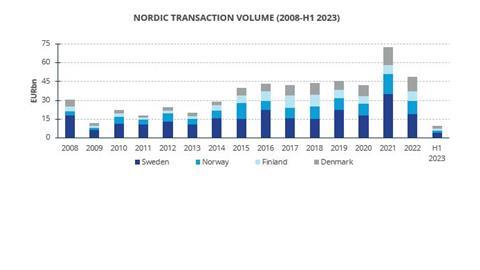

Real estate transaction volumes in the Nordics slid to their lowest level in 10 years during the first half of 2023 as investors shunned expensive direct investments in favour of funds and debt, new research from Colliers reveals.

First-half transaction volumes amounted to €9.6 bn, down 68% on the year-earlier period, as dealmaking slowed across all Nordic countries.

‘We are seeing a dramatic slowdown in the transaction market, partly due to book values and price expectations adjusting very slowly to the higher interest rates. This makes directly owned properties expensive, in relative terms, and instead many investors turn their attention to discounted listed real estate, real estate funds, or real estate debt,’ said Mikael Söderlundh, head of research and partner at Colliers Nordics.

He added: ‘There is a strong interest in commercial properties, but the capital is finding new paths.’

A notable trend highlighted by Colliers is that listed property companies have gone from being the largest net buyers to the largest net sellers in recent years.

Whereas listed firms accounted for 49% of all acquisitions in Sweden in 2021, their share dropped to 10% in the first half of 2023. In the absence of listed companies, many real estate funds, foreign investors and strong private players have stepped forward.

‘There is almost an unlimited amount of capital available,’ noted Bård Bjølgerud, CEO Nordics & partner. ‘Just the Nordic real estate funds have up to €8 bn in uninvested equity and double that in acquisition capacity. However, they still consider it too expensive and believe that prices need to be adjusted downward.’

Logistics deals accounted for 28% of total Nordic volumes in H1, overtaking other sectors as the biggest segment for the first time. Colliers attributed this to the high share of foreign investors, which had led to faster price adjustment for properties.

Residential transactions accounted for a 25% share of the total, followed by offices at 17%.

The firm expects dealmaking activity to pick up towards the end of the year, albeit amid continued tough trading conditions.

‘In the autumn, we expect a continued turbulent market with companies struggling, but activity will increase as buyers and sellers find each other. There are also conditions for further consolidation and structural deals in the market,’ Bjølgerud concluded.