Arlington Investors, a London-based wealth manager backed by family offices and Middle Eastern investors, has acquired 11 student accommodation buildings in the UK for a total of £85 mln (€99 mln).

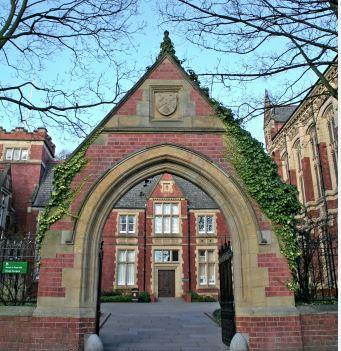

Ten of the assets are leased to the University of Leeds, and the final building offers 232 studio apartments that are rented directly to students in London. The vendor was Rockspring.

TradeRisks was the debt arranger and placement agent for the transaction. Funding for the London transaction was arranged through a listed bond which was privately placed with clients of Legal & General Investment Management (LGIM), while the funding partner for Leeds was Aviva Investors.

The acquisition is the latest addition to Arlington’s portfolio in the sector, taking its holdings to more than 7,800 beds and a total investment of over £500 mln.

Arlington's other student accommodation holdings include 1,445 beds acquired from Spectrum Housing Association and Sanctuary Housing Association in March 2016 with another 492 currently in development, 400 beds from Goldsmiths, University of London, in 2015, and 4,539 beds from the portfolio of the former Opal Student Property Group in a £245 mln transaction in 2014.

Established in Jersey in 2013, Arlington Investors is backed by family offices and investors from the UK and the Middle East, with a mandate to invest globally and a current focus on high-quality UK property investment.