Two recent reports on the UK lending market sound a note of caution as new loan origination and LTVs creep up again while property investment volumes fall.

UK lending is enjoying a fifth year of stability, but there are reasons to be cautious according to the two leading annual surveys of the market.

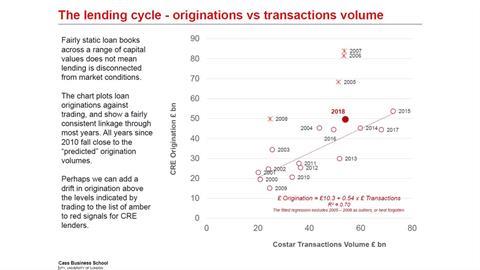

The Cass Business School 2019 UK Commercial Real Estate Lending Report (formerly the De Montfort report) says that the combination of a 12% rise in loan origination in 2018, coinciding with 12 months when investment transactions actually fell 13%, is a reason to monitor the market this year especially carefully.

And the latest annual Laxfield Capital UK CRE Debt Barometer highlights three potential future problems for the UK property market: the lack of transparency about debt fund lending, the large amount of debt provided by international investors and dwindling liquidity for retail landlords.

The Cass report says that last year, lenders wrote almost £50 bn (£49.6 bn) of new business, which was a 12% rise on 2017. At the same time, a total £54 bn of property transactions was recorded, according to Costar, representing a 13% volume drop.

The Cass report’s author, Dr Nicole Lux, said: ‘Historically a relationship of 1:1 could easily lead to an overheating market and 2019 needs to be carefully monitored.’ She points out that before and after the global financial crisis there was a persistent tendency in the UK for every £1 in real estate transactions to generate £0.5 in loan origination.

The last time that relationship broke down was in the run-up to the GFC itself, during 2004-2008, ‘when loan originations stood far above the level indicated by market activity, and ran on after strong market signals such as peak rates in capital growth and even falling capital values’.

Lux says there is another metric which suggests that new lending is creeping up again: ‘This is also confirmed by an increasing share of new loan origination against outstanding loan books, which reached 29% of turnover in 2018 compared to a 10-year average of 20%.’ However, she adds that it is too soon to tell whether one year – 2018 – was or was not a sign of overheating, because new debt tends to lag new deals by about one year. Thus, ‘it remains to be seen if the debt market was just catching up in 2018’.

On a positive note, the 2018 origination figure still falls into a tight band of annual loan originations since the market stabilised in 2014, which followed a period when lending contracted after the financial crisis. The range between 2014-2018 was £45 bn to £55 bn, with the £55 bn peak in 2015 – a busy year for UK transaction volume.

New types of lender

On the other hand, a further reason to be cautious is that the Cass report does not capture all lending and is therefore understating the true 2018 lending figure (although it does estimate uncaptured data).

At Laxfield co-founder Emma Huepfl’s presentation of the latest Laxfield Barometer in London on 25 April she observed there is not much available information about the activities of many debt funds and newer private lending companies. Laxfield identified 212 ‘front line’ lenders with an estimated market capacity of £96 bn compared to the 75 organisations which responded to the Cass survey.

‘My point is not whether this is good or bad, but to demonstrate how the market continues to change and evolve and probably needs a better understanding,’ she said. ‘There’s a risk that some of the capital at work in the market may not be fully understood or indeed recorded at this point. The supply side may hold hidden risks – the market is not fully mapped.’

Laxfield acknowledges that not all 212 lenders are active at any one time. Furthermore, Cass does receive data from most big banks and insurance companies. And the new, more diverse lending marketplace, with more providers plus a wider range of lender sizes and business models, should spread risk.

Higher-yield lending

However, it seems that many high-yield lenders face challenges deploying capital. Laxfield estimates more than half (56%) of the £96 bn of capacity is targeted at higher-yield lending, broadly returns of 5-6% and upwards. That implies more specialised areas of lending where borrowers would be prepared to pay higher margins. ‘So, proportionally, it appears to me that there is much more high-yield money than there is demand for that debt,’ Huepfl said.

The Cass survey picks this up in comments from respondents. ‘There is high demand from investors for investment yields of 6-9%, which means substantial capital is targeting higher risk/junior debt financing opportunities,’ one lender said. The report recorded that more than half of lending by ‘non-bank’ lenders is at loan-to-values higher than 60%.

Pursuit of higher yield lending deals could pose a possible risk of loosening controls over loan structures, although, so far, ‘it is not what we are seeing’, Huepfl said. One Cass respondent observed however: ‘There is pressure on lenders for covenant-lite loans, borrowers asking especially for no-default covenants.’

Another trend is for high-yield lenders to get a higher yield by providing vanilla or senior loans but leveraging the deals. Laxfield’s data suggests that two-thirds of the market is supplied ‘by capital that makes global choices’. Peter Cosmetatos, CEO of the European Commercial Real Estate Finance Council (CREFC), joined Huepfl in pointing out that this is also a potential risk. As Huepfl noted: ‘If the UK were subject to an isolated economic downturn, if we don’t sort out Brexit, we do run the risk that debt liquidity could quite quickly get more scarce.’

Laxfield records and analyses finance requirements at the earliest stage, when borrowers approach lenders seeking terms. Its databank includes £130 bn of loan requests across 2,295 deals.

Debt liquidity for UK retail is ‘starting to dry up’

Pricing for UK retail loans has more than doubled in the last four years, reflecting the sector’s ‘ejection’ as a core asset.

In Laxfield Capital’s latest UK CRE Debt Barometer, the debt investment manager says the weighted average margin for a loan secured on retail has climbed from 180 basis points in 2014 to 397 bps by the end of December 2018. Laxfield’s Emma Huepfl says that assessing the risks of retail in the UK was ‘an incredibly difficult place to be’ for a lender.

‘The acceleration of CVAs that we’ve seen in the last two years has really made the contractual base of the cashflow, which historically is where the lender would have started, legally unreliable.

‘Currently, we are in danger that debt liquidity at a sensible price is starting to dry up for all but the best (retail) assets.’

Huepfl said there has been a ‘strong shift’ in the pattern of demand for property sectors in the five years since Laxfield started the Barometer. ‘Offices are gradually becoming less dominant within the overall pipeline and demand for bed-based funding, hotels, student housing and PRS, has become much greater,’ she said.

‘When we think about how we used to divide our pipeline, by the core sectors of offices, retail and industrial against non-core, which would have been operational property, it feels as if it’s been turned on its head.’

She said that as operational assets have become more mainstream, lenders have to ask themselves: ‘Are they really capable of understanding operational businesses and are they lending to the people who really understand how to manage them?’

The Cass report also found pricing for loans secured by retail property increased while the volume of lending against retail has declined sharply. ‘What is clear is the demise of retail property,’ said CREFC Europe CEO Peter Cosmetatos. ‘The sector now accounts for just 15% of the collateral for the debt covered by the report. It remains to be seen how investors and lenders can work their way through a very challenging situation,’ he noted.

CASS REPORT – KEY POINTS

• The market share of new lending by non-banks in the Cass report inched up again in 2018, to 26% of new originations (£12.8 bn) from 23% in 2017. Insurance companies increased origination activity by 21% and other lenders by 26%.

• German banks were the most concerned about the UK political environment, and paused their lending activity towards the year-end.

• Lending against residential development fell, despite significant growth in build-to-rent projects and respondents said some lenders on development are demanding their borrowers refinance them out.

• Residential sales on some development schemes have been slower than expected, putting some development loans into default.