London offices with a sustainability rating such as BREEAM, LEED, or HQE, command a 25% premium compared with comparable buildings without a rating, according to a new MSCI study of sales prices of completed transactions.

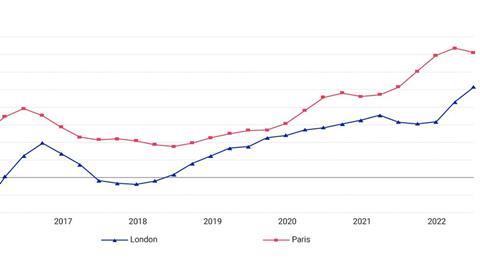

The premium has been growing steadily since the second half of 2018 and has accelerated notably this year as buyers and occupiers place a greater emphasis on reducing carbon emissions.

MSCI found that the ‘green premium’ is even more pronounced in the Paris office market, where it stands at about 35%.

Analysis of prices paid by investors for offices in London and Paris, Europe’s largest property markets, shows a premium has emerged for buildings that have sustainability ratings from organizations like the Building Research Establishment (BREEAM), U.S. Green Building Council (LEED) and GBC Alliance (HQE), versus those that have not yet achieved these standards.

In London, a substantive gap appeared from early 2019 onward, which underlines this is the point at which the industry started to address sustainability issues in a serious way. The gap has accelerated through the last two quarters to stand at more than 25%, as buyers put even greater emphasis on buildings that meet their and their occupiers’ requirements. In fact, many of the world’s biggest property owners have ambitious carbon-reduction targets and intend for their portfolios to become net-carbon-neutral in the medium term.

For Paris, the gap emerged in 2016, but has also grown significantly since 2019 and now stands at more than 35%. A premium at this level shows a considerable bifurcation in the market — and one that may continue, given the ongoing emphasis on decarbonization of property portfolios, MSCI said.