Investment in CEE real estate in 2017 is likely to surpass last year’s record as Asian, US and domestic players drive new deal activity.

Last year’s record-breaking €12.2 bn investment in the real estate sector in Central and Eastern Europe is likely to be exceeded in 2017, according to the CEE Real Estate Investment Compass 2017 published by Colliers International and international law firm CMS.

The sources of investment flows into the CEE region are also expected to remain diverse in 2017, with Asian and CEE investors becoming increasingly active in the real estate market. The CEE Real Estate Investment Compass 2017 examines key trends in the real estate market in six Central Eastern European countries (Bulgaria, Czech Republic, Hungary, Poland, Slovakia and Romania) over the last five years, and takes a look at what is on the horizon for 2017.

In the first quarter of 2017, preliminary real estate investment in the CEE-6 markets stood at €2.3 bn, representing a 41% and 45% increase compared with Q1 2016 and Q1 2015 respectively. Based on the estimated Q1 2017 figures, the Czech Republic received 62% of the total real estate investment in CEE. Preliminary indications from the first quarter of 2017 also suggest continued significant local investor activity in Hungary and the Czech Republic and the entry of Thai investors into the latter and Poland.

Growing maturity

Looking at trends in 2017 in the CEE region, increased returns via lower yields are predicted in Budapest and Bucharest (in all three main segments of the real estate market: office, retail and industrial), Prague (in office and industrial) while in Bratislava (all sectors), Warsaw (industrial and retail) and Sofia (office and industrial) similar market conditions are expected.

‘The growing maturity of the CEE region may help combat the specific risks affecting Western Europe, that of “Brexit” and its reverberations, which may unfold further in 2017. Brexit’s full consequences are not yet known and some might even end up as a positive for CEE,’ says Mark Robinson, senior researcher for CEE at Colliers.

Western Europe and US capital

According to the report, higher returns and solid prospects for rental growth in CEE are likely to encourage Western European and US capital flows to continue at a similar level to the €4.9 bn reached in 2016.

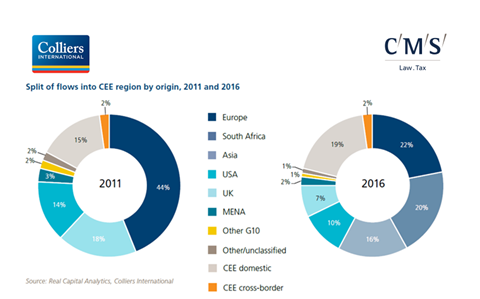

Western Europe remained the main source of investment in the CEE real estate market last year but the inflow of South African (20%) and Asian (16%) capital reduced its share to 22% of total investment into CEE real estate compared to 44% in 2011. Meanwhile, UK activity is predicted to remain at around 7-9% of total investment into CEE real estate sector in 2017.

Important market shift

A marked shift took place in 2016 with South African, Asian and CEE investments surpassing those from the G10. Flows from these regions are predicted to continue this year, with Asian and domestic/CEE sources continuing to drive new investment in the region, the report reveals. Large portfolio-type deals involving Asian investors may become more common in CEE’s real estate sector, resulting in deal values matching or even exceeding last year’s results, given the large number of potential capital sources.

Interest from Asian investors in the region, particularly in Poland and Hungary, has grown considerably over the last three years, with total investments reaching €2 bn in 2016. South Africa’s activity meanwhile reached a record level of €2.4 bn in 2016. While its activity in 2017 might not match that of last year, with over 10 of the domestic REITs committed to the CEE region either directly or indirectly, deals should still be executed. ‘If oil and commodity prices sustain at present levels, we should also expect to see more interest from Turkey, Brazil, Russia and MENA countries in 2017,’ says Luke Dawson, managing director and head of capital markets, CEE from Colliers.

Growth of CEE domestic investors

Cross-border and domestic flows have more than doubled in the last five years, reaching €2.6 bn in 2016, a strong sign of maturity in the region. The Slovak and Czech markets were both the largest origins and destinations of CEE cross-border investment flows in 2011-16, while Hungary’s domestic flows have grown most rapidly in recent years.

‘The further distance we get from 1989, the more developed the CEE markets become and the less reliant on outside investors we are. This can be observed not only in the real estate sector, but in the whole M&A market,’ says Wojciech Koczara, partner at CMS. ‘The spread of Warranty & Indemnity insurance across the CEE markets is another sign of growing maturity in the region as well as the increased level of sophistication in the structuring of large real estate deals.’

Domestic investors are becoming increasingly comfortable with market liquidity, and with commercial real estate market capitalisation estimated at between 55-65%, local investors such as those in Poland who only executed 2% of deals in their local market in 2016, may be tempted to become more active. The main risk to domestic activity in CEE in 2017 is a global economic slowdown, perhaps triggered by higher bond yields or China’s debt pile.