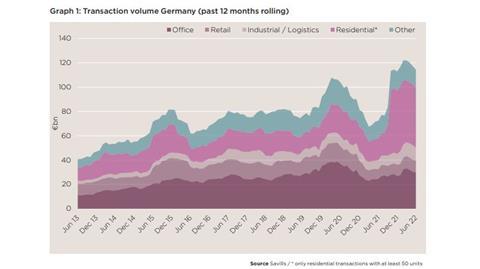

Real estate transaction volumes in Germany could end the year around 18% lower compared to 2021 levels, in a sign that the ‘exceptionally long bull market’ in Europe’s biggest market is over, says Savills.

The firm bases its prediction on investment volumes in Q2, which totalled just €8 bn after more than €20 bn of transactions were recorded for Q1.

Savills expects full-year volumes for 2022 to come in below €50 bn, against €60.7 bn last year.

‘The exceptionally long bull market in German real estate investment, which has produced yield compression and rising or sustained high transaction volumes over the last 12 years, is over,’ the firm said, adding that current period of adjustment heralds the start of a new cycle.

Marcus Lemli, CEO Germany and head of investment Europe at Savills, commented: ‘While market participants have been anticipating a reversal in interest rate policy and a potential correction in the real estate market for some time, they have been surprised by the speed at which this transformation occurred.’

However, he noted, the current less competitive market environment offered opportunities for investors willing and able to make acquisitions.

‘We expect many of the buyers who have withdrawn from the market for the time being to return in the autumn. Provided that the financial and economic environment remains stable between now and then, we expect a smooth cyclical transition despite the current faltering market.’

He continued: ‘The pressure to invest for many buyers appears as high as ever and, in a world of higher inflation, real estate could even become more attractive as an asset class. Furthermore, the lettings markets have remained predominantly stable thus far, with rental growth prospects even improving in some segments.’

The decline in transactional activity currently being witnessed is primarily due to a bigger gap in price expectations between buyers and vendors, according to Savills. This divergence is greater in the core segment than in the value-add segment owing to the higher interest rate sensitivity.

Matthias Pink, head of research at Savills Germany, said: ‘The extent to which prices have already corrected is difficult to determine owing to the low number of transactions. Price corrections depend on how interest rates develop as well as other parameters, such as expectations as to rental growth and inflation. These might moderate the interest rate effect in some segments but strengthen it in others.’

Moreover, despite the sharp rise in interest rates, most owners are not under pressure to sell and would rather decline a sale than sell at a lower price, said Lemli. ‘This demonstrates that the whole cycle was dominated by equity-rich investors. In addition, while debt has become more expensive, it still remains available. This differentiates the current downturn from the financial crisis.’

Hence, he observed, ‘the possibility of ‘bargain’ investments from distressed situations, for which some investors are already lying in wait, is probably rather unlikely and principally limited to the development segment’.