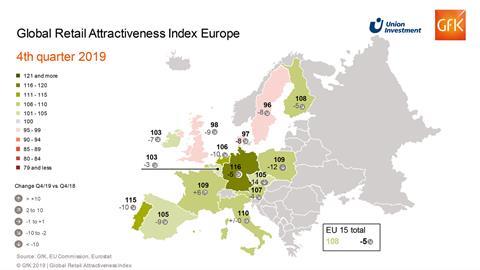

The European retail markets are still doing well despite declining economic momentum, with a score of 108 which is significantly above the long-term average, according to the Global Retail Attractiveness Index (GRAI) compiled jointly by Union Investment and GfK.

The result means Europe as a whole fell slightly (by 5 points) compared with the previous year but it is faring much better than North America (98 points) and Asia-Pacific (96 points).

Germany experienced only a slight decline (-5 points) compared to Q4 2018 and remains the strongest retail market with 116 points, while Italy remained at 110 points. France actually improved and is the only country among the European top 15 to record an increase (+6 points). The index lost some ground in the UK, Denmark and Sweden as a result of weaker growth.

Despite the downward trends also being seen in Europe, the gap between North America and Europe widened during the year from 1 to 10 points, while the gap between Asia and Europe is now 12 points.

'The labour market and consumer sentiment were the main sources of support in Q4 2019 and are key to the overall strong showing of the index in Europe. By contrast, retail sales performance is having a dampening effect. In the current environment, it remains a major challenge to find good investments with secure cash flows that also offer the prospect of appreciation,' said Henrike Waldburg, head of Investment Management Retail at Union Investment.

Polarising landscape

The subdued economic backdrop was an adverse factor for nearly all retail segments including online retail and was leading to greater market polarisation, added Waldburg. This made it necessary to be even more cautious when selecting assets.

'Retailers in smaller, non-dominant schemes in secondary and tertiary cities will face difficulties. In contrast, dominant shopping locations with attractive offerings that reflect changing consumer behaviour and customer needs will find it easier to cope with the structural changes taking place in retail.' She cited the example of the Puerto Venecia shopping resort in Zaragoza, one of the three busiest shopping malls in Spain. 'The average dwell time here is three hours, which is one of the reasons we decided to invest here last year.'

In the current economic environment, retail parks have also proved to be particularly resistant to online competition and therefore able to hold their value, especially those buoyed by major food anchors on long leases. 'Germany still has some catching up to do, especially when it comes to community shopping centres,' said Waldburg.

In the GRAI, the top three countries are currently Germany with 116 points, Portugal with 115 points and Italy with 110 points. Poland and France also score above average in the European index, with 109 points each. The lowest placed country in Q4 2019, with just 96 points, is Sweden. Denmark and the UK are also below average, with 97 and 98 points respectively. During the year, the Czech Republic (-14 points), Poland (-12 points), the Netherlands and Portugal (-10 points each) saw the sharpest declines in the Retail Index.