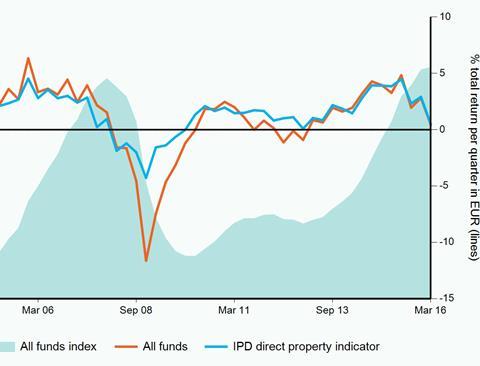

Pan-Europe property funds delivered a net fund return of 0.4% in the first quarter 2016, a decline from 2.8% in the previous quarter and from 3.3% in the same period a year earlier, the IPD Pan-Europe Quarterly Property Fund Index shows.

The property market was affected by the volatility and uncertainties that marked the year’s beginning; and it signalled a moderation in the Index after several quarters of robust returns. Nevertheless, the IPD Pan-Europe Property Fund Index outperformed equities and property equities (Equities, -4.8%; property equities, 0%).

Underlying assets held in these funds recorded a similar slowdown. Direct asset-level return moderated to 0.5% in the quarter to March 2016, down from 2.9% in December 2015 and 3.9% in March 2015. Capital value growth turned negative for the first time in two years, registering -0.8% in the first quarter 2016; although the balanced funds sub-sample fared better as capital value held its position.

Over the 12-month period ending in March 2016, the IPD Pan-Europe Quarterly Property Fund Index recorded a total return of 10.4%. This is a marked slowdown from 13.5% recorded for the same period ending in December 2015 and was the lowest since June 2014.

Bert Teuben, vice president of MSCI, commented: '2016 began with much volatility in the markets. As a result, many asset classes experienced a slowdown in the first quarter. And to a large degree, the Index basically moderated after several quarters of very robust returns.'

Teuben continued: 'The slowdown in commercial real estate in the first quarter was recorded across all European regions. Still, real estate outperformed equities in Europe in the first quarter. On a 12-month basis fund level performance outperformed both equities and bonds.'

The IPD Pan-Europe Property Funds Index tracks the performance of 14 funds, with a total value of €16.8 bn and NAV of about €12.3 bn.