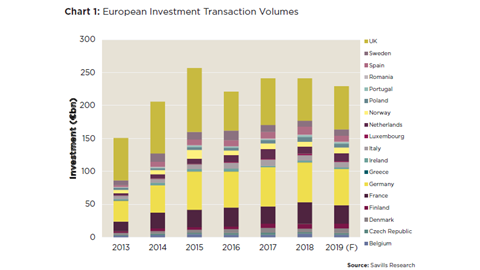

European commercial real estate investment volumes are forecast to reach €230 bn by the end of the year, meaning that more than €200 bn will have been invested in European commercial property for the sixth consecutive year, according to new research from Savills.

While 2019 volumes are not expected to reach the highs of 2017 and 2018, when they exceeded €240 bn, the advisory firm notes that the 'winning streak' is unprecedented in the history of the European investment market.

According to the international real estate advisor, whilst Germany, the UK and France will continue to attract the lion’s share of investment, Poland (+46%), Denmark (+38%), Finland (+32%) and Portugal (+27%) are all forecast to significantly see commercial investment volumes exceed their respective five year averages in 2019 (see Chart 1).

The US, followed by Singapore and South Korea made up the three largest non-European investor groups in 2018 and are forecast to continue to dominate in 2019, says Savills.

Lydia Brissy, Director, European Research, Savills comments: 'The US remained the major contributor in the European property market accounting for 48% of the non-European volume recorded in 2018 at €27.4 bn, with France becoming their main targeted destination followed by the UK and Germany.

'At the same time, Singaporean investments in Europe almost doubled from €2.9bn in 2017 to over €5.6bn in 2018, accounting for 10% of the total overseas volume and making them the second biggest non-European investor group. South Koreans invested €5.4 bn in 2018, up from €4.89 bn in 2017, the third biggest investor group. While continuing to target offices in CBD locations they have recently broadened their market coverage to non-core countries, notably Belgium, Poland, Italy, Ireland, Denmark and Spain.'

Altering asset focus

Mike Barnes, Associate, European Research, Savills, added: 'As well as logistics, multifamily investment in core cities with strong demographics will remain high on the wish list of investors this year. In the Netherlands, for example, we expect total residential investment volumes to be in line with office investment volumes. We also expect an increasing proportion of new office and residential space to be delivered in mixed-use schemes as landlords look to diversify their income pool.'

The report that the gap between average European Prime Office CBD yields and 10-year government bonds is wide by historical standards (212 bps in 2018, compared to 185 bps in 2008/2009, see graph below) and as long as this gap remains, buyers will continue to invest in commercial real estate to receive higher returns in an income-led environment.