European commercial real estate investment tumbled last year to the lowest level since 2012, according to the latest Europe Capital Trends report from MSCI Real Assets.

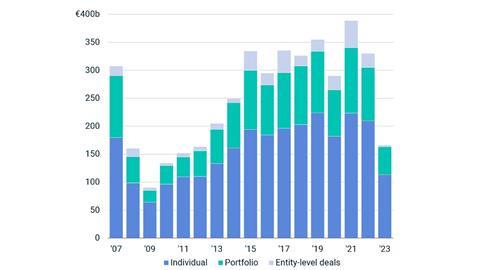

High interest rates and lacklustre economic growth preserved a wide disparity in pricing expectations of buyers and sellers, depressing transaction activity. The volume of completed transactions in 2023 halved from a year earlier to €166.1 bn, sparing no market or sector, the report showed.

Property sales declined 43% in October through December from fourth-quarter 2022, to €41.1 bn. That left Europe’s overall investment activity in commercial real estate more than 60% lower than at the peak registered in June 2022.

Tom Leahy, head of EMEA Real Assets Research at MSCI, said: 'Last year was not a great vintage for European real estate. Our pending transactions data point to a continuation of the subdued activity with property values still falling for the most part. The painful adjustment to higher interest rates is taking longer in real estate than for other asset classes – a reflection of the time required to transact and the illiquid nature of heterogeneous property assets. We are seeing only certain pockets of the overall market showing signs of bottoming out.'

The MSCI Price Expectations Gap highlights how much further prices may need to adjust for a return to more normal levels of transaction activity. Some of the largest differences in pricing centre on the office sector, a result of the impact of hybrid working and buildings needing to meet higher environmental standards. MSCI’s model indicates a pricing differential of -41% for offices in Germany’s A Cities, -28% for Paris and -48% in Amsterdam, underscoring the extent to which asking prices would need to fall to meet the discounts demanded by buyers.

While every type of real estate registered lower transaction volumes, offices remained the largest sector in Europe, even as the number of properties sold sank to a record low. There were €43.9 bn of offices sold in 2023, down 59% from a year earlier.

Number of traded offices at a record low

Hotels were the least badly affected sector last year, down 18% from 2022, following notable transactions in the French and Spanish markets as leisure travel rebounded. Elsewhere, activity in the UK and Swedish industrial markets recorded relatively healthy levels above the pre-Covid pandemic average of 2015-2019.

Paris ended the year as Europe’s top investment destination, overtaking London. Seven of the 10 largest single property sales last year took place in the French capital, led by luxury goods chain LVMH’s purchase of its flagship store at 150 avenue des Champs-Elysees. The acquisition, for €1 bn, reflects a broader pattern of occupiers buying the buildings they were previously renting. These larger transactions limited the contraction of the French market as a whole to -38% last year, for a sales total of €26.7 bn.

Distress in Germany

The UK remained Europe’s largest investment market even as the challenges for the office sector led a 42% fall in overall transaction volumes. In Germany, activity was the slowest since 2010, with a 54% decline to €27.9 bn. The country’s valuation system does not encourage rapid adjustment to values, contributing to the -31% price expectations gap for offices nationwide.

Germany also accounted for 55% of the assets in a position of distress at the end of 2023, according to the MSCI Real Capital Analytics database. Sources of concern are the loan-to-value and loan-to-cost metrics employed by German banks during their lending boom in the low interest rate era that followed the Global Financial Crisis.

Tom Leahy concluded: 'We may have a little longer to wait for a recovery in dealmaking in Europe’s markets. If central bankers decide to bring interest rates back down again, this will certainly bring welcome relief. There remains, however, a more fundamental question of real estate’s place within investors’ portfolios relative to other asset classes, notably bonds, now the record low interest rate environment is finished. This will impact allocations to property assets and dictate investor expectations for future returns.'