ECE, the Hamburg-based real estate company, has attracted commitments from renowned institutional investors, including two large German insurers, for its new ECE Better Living Europe Fund.

The firm has held a first close and is planning on making investments of more than €350 mln, it said in an update.

Further capital is expected to be raised over the coming months.

ECE’s specialized in-house company, ECE Living, is working on the strategy together with investment banking boutique, Victoria Partners.

The focus is upon newly-built residential quarters for rent particularly by professionals in attractive locations in European metropolises.

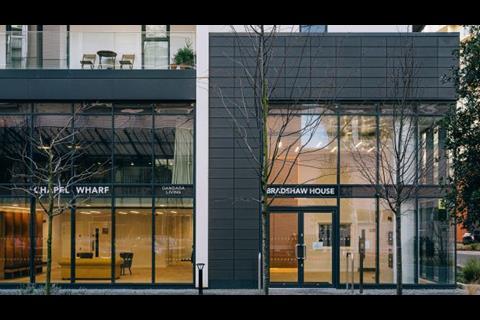

Initially, the fund has made investments in two build-to-rent properties in Leeds and Manchester in the UK with a total of 974 residential units that are already fully let. Further expansion of the portfolio through acquisitions of properties in various major European cities is already in the pipeline.

‘With our new ECE Better Living Europe Fund, we are successfully expanding the investment spectrum managed and offered by ECE to include investments in modern, sought-after residential properties,’ said Henrie Kötter, managing partner of ECE Living.

Jan-Hendrik Walloch, also managing partner of ECE Living, added: ‘The fact that we succeeded in raising high capital commitments from renowned investors in the current market environment with rising interest rates and costs, high inflation and a growing uncertainty is a great success and speaks for the quality of our product and the sustainability of this concept.’

ECE has been changing for more than a decade from being a pure shopping centre operator into a multi asset class investment manager. It entered into real estate investment management in 2010 when it launched its first ever discretionary fund – a shopping centre vehicle - assisted by what was then the powerful placement agency business of Credit Suisse.

Other investment classes include hotels. The firm has been busy raising the ECE European Lodging Recovery Fund.