The proliferation of alternative lenders and the level of uncertainty in the market are leading to the seemingly unstoppable rise of brokers, delegates have heard at the Autumn Conference organised by the Commercial Real Estate Finance Council (CREFC) in London.

'There is no one stop anymore for borrowers, you have to shop around,' said Colin Throssell, EMEA director of finance at TH Real Estate. 'Relationship banking is a thing of the past and this is why brokers or intermediaries have become so important and successful.'

He was participating in a panel on 'Borrowers and lenders sounding out Brexit', at which TH Real Estate brought the global view on the market, M7 the Pan-European perspective and Quintain the British outlook.

In the last twelve months the market has become much more intermediary-led, experts agreed, as borrowers seek out advisors who can cross boundaries and facilitate access to the deep pools of capital that are out there.

They have become increasingly skilled and professional and there is a definite role for them, but not all companies need them, Throssell said: 'There is a definite skill involved in borrowing, but if you have a team of in-house negotiators then you don't need intermediaries, and investors can feel short changed by the increased outsourcing to them.'

Quintain has just closed a deal with three lenders for a large residential build to rent development in Wembley, in London. 'The UK banks were approached but were unable to be competitive due to the nature of the loan, while Eurozone lenders were very happy to talk to us,' said Cath Webster, strategic finance and investment director at Quintain. 'We ended up doing the deal with three North American lenders, only one of which is a bank. We discussed the deal with a wide range of lenders who are all active in the market.'

Quintain was bought by US private equity giant Lone Star last year, but 'for a start up or a company with no significant backer or track record, then it is very difficult to get finance,' said Throssell.

In the UK being a borrower has become harder and more expensive by an average of 20bps since the EU referendum in June, because risk has gone up and senior lenders have become even more cautious. In the development space the market is totally polarised, said Webster: ‘There is the safe low LTV level then a gap and then the much higher leverage offers. It would be good to see more people in the middle section, and I think opportunities are being missed.

Despite the mixed picture, a snap poll at the CREFC Conference on whether today it is preferable to be a lender or a borrower had a very clear result: 76.7% of delegates think it is better to be a borrower, with only 23.3% wishing to be in the lender's shoes.

In the current unpredictable geopolitical landscape 'planning has become a fool's mission,' said Richard Croft, CEO of M7. 'You have to focus on income. I believe cash flow will become THE asset for the next five years.'

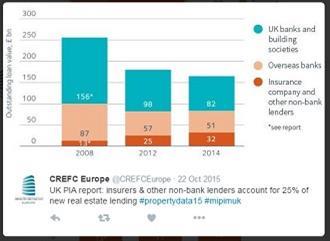

A report by the UK's Property Industry Alliance published in October 2016 showed that insurers & other non-bank lenders account for 25% of new real estate lending.