A new report from BNP Paribas underlines the acceleration of the co-working trend across Europe, while warning that 'unprofitable' metrics should inspire a sector rethink.

'After the explosion in the number of coworking spaces in recent years, which has jumped from about 1,000 worldwide in 2012 to over 18,000 today, the market should be stabilising or even consolidating in certain places,' said Richard Malle, global head of research, BNP Paribas Real Estate.

'Given that a quarter of coworking spaces around the world were still unprofitable in 2018, the market needs to have a rethink and evolve over the coming years,' Malle added.

Rapid expansion

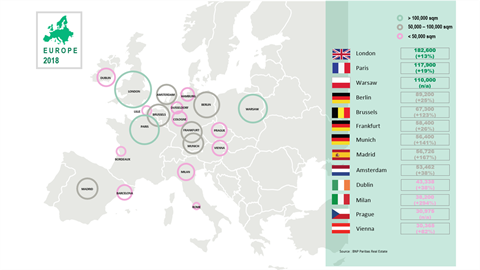

According to the research, the number of coworking spaces and their average size has increased in Europe, with London retaining the crown for the densest network in 2018, boosting its supply with over 180,000 m2 of new coworking space (+13% vs. 2017).

Nevertheless, out of the 18 European cities analysed, Vienna, Milan, Cologne and Dublin have enjoyed particularly brisk markets with rapid expansion.

The data shows that Vienna and Milan in particular achieved record performances with respectively 30,365 m2 and 38,211 m2 of new coworking space, marking increases of 449% and 294% compared to 2017.

There were six deals in Cologne in 2018 for a total floor area of 29,200 m2 (+161% vs. 2017). Lastly, eight deals totalling 43,338 m2 (+122% vs. 2017) boosted the Dublin market, which saw an average transaction size of 5,417 m2, the biggest in Europe.

Ever-larger units

In line with the expansion data, the trend in 2018 was towards the leasing of larger units, notably in Vienna where the average deal was for around 5,000 m2 (+83% vs. 2017). This was largely due to big global players arriving on the market who are 'comfortable with large buildings', BNP Paribas suggested.

In Amsterdam, deals in 2018 averaged around 3,500 m2 (+29% vs. 2017). Meanwhile in Madrid, the average coworking unit was 2,701 m2, representing an increase of 10% vs. 2017.

Overall, London, Paris and Warsaw dominate the European coworking market, driven by the presence of the big international brands. BNP Paribas said that London had 70 new schemes in 2018, mainly in the City and West End, while Paris saw 28 transactions, representing total floor space of 117,866 m2 (+19% vs. 2017).

The coworking market in Warsaw was meanwhile boosted by 109,978 m2 in 2018 with 32 new spaces, of which over 40,000 m2 is owned by one of the global leaders in the sector.

Flexibility paradigm

Malle warned that the flexibility enjoyed by occupiers wasn't extended to the coworking brands themselves, who are 'signing up to leases without break options and have to make their models profitable over the long term', Malle noted.

'Moreover, independent players without the means to take on the big brands are bound to position themselves on specific segments.

'However, the trend is towards new forms of collaboration and coworking is now a fixed part of the service landscape,' Malle concluded.