The fall-out from Covid will combine with the finalisation of Basel III to speed up the increasing market share of non-bank over bank lenders, finance experts say.

Pan-European real estate fintech business Finloop has seen growth in the lending volumes on its year-old service from circa €400 mln in Q1 2021 to a projected €5 bn by the year end.

It says that this is partly due to lenders and borrowers realising that Finloop reaches a broad spectrum of closely matched counterparties, including for more challenging sectors hardest hit by the pandemic, such as hotels, retail, offices and development.

The platform has many alternative lenders as well as banks among its 1,500 registered finance providers.

Thomas Schneider, CEO, and the co-founder of Finloop with academic Nicole Lux, said the rapid growth was also ‘partly due to the growing confidence of financial markets in using proven and secure fintech applications in the Covid-19 pandemic.’ Finloop was launched in January 2021 to match borrowers and lenders and also provides loan management software.

Separately, a recent report for clients by the research team at PGIM Real Estate, says: ‘We expect the transfer of debt capital from banks to nonbanks to happen more quickly than originally anticipated, accelerated by the Covid-19 pandemic.’

European real estate debt: where next? also highlights the effect on the lending market of the finalisation of Basel III and its revisions, which seek to address the differences between large banks’ mainly internal ratings-based approach for writing loans and the standardised approach which tends to be used by small or new banks.

One revision places a minimum requirement on bank regulatory capital on internal models which means banks will have to hold more regulatory capital. The European Banking Authority says this increase could lead to a capital shortfall of €125 bn. Non-Basel III compliant banks currently carry no minimum regulatory requirements for lower credit-risk loans, PGIM points out.

PGIM also highlights how it expects the pandemic to create further opportunities for nonbanks. The European bank market is typically a five-year one and Covid is causing a financing backlog because it is delaying refinancing of loans falling due.

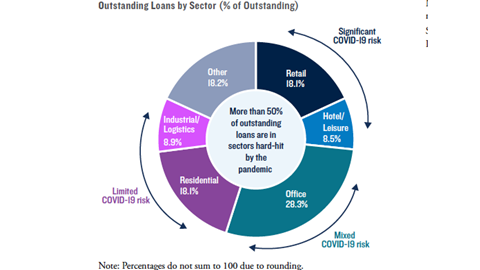

‘Some of those loans would have been made to sectors hard-hit by the pandemic such as retail, hotel and office. So those loans’ credit risk would have deteriorated, thereby making it difficult for banks to refinance or forcing them to do so at higher regulatory costs’, the report says.

‘ Therefore, banks may no longer want those exposures or are simply unable to underwrite the risk.’

PGIM has a debt fund series in Europe and was one of the first nonbank lenders into the market after the global financial crisis.

The number of investment managers launching debt products continues to grow on the back of investor demand and so far has not shown signs of slowing down. PropertyEU tracked 13 this year in its Weekly Data Sheet.

Finloop has just agreed a white label deal with Adelaer which will see the Dutch commercial property financing broker have exclusivity. Adelaer claims to be the largest CRE financing broker in the Netherlands.