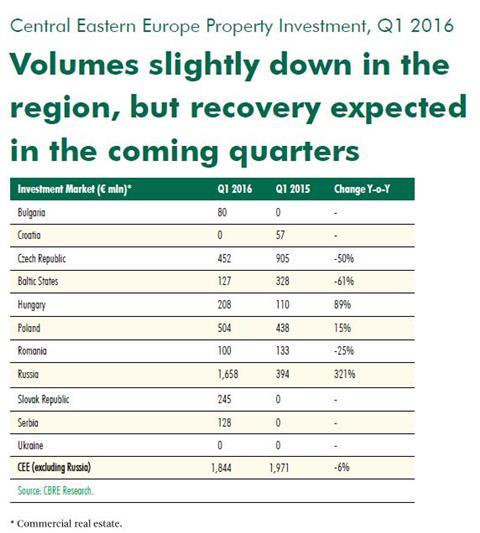

Investment into Central and Eastern European (CEE) countries (excluding Russia) registered a slight decrease of 6% year-on-year amounting to €1.84 bn in the first three months of 2016.

Property adviser CBRE said however that it expects 2016 investment volumes will reach and exceed the record volumes of 2015.

'2016 is expected to be a record year for the entire CEE region, with Hungary, Slovakia and Romania catching up and becoming stars of the region. No doubt, interest for core-CEE markets, Czech Republic and Poland, will remain very strong and new records might be established in 2016,' said Andreas Ridder, chairman CEE at CBRE.

According to new research published by the broker, the quarter was dominated by a multitude of small and medium size transactions, for all core real-estate sectors. The average transaction price in Q1 2015 was over €45 mln across less than 50 transactions within the region. This is compared to Q1 2016, where the average transaction price was €24 mln, from more than 110 closed transactions.

Compared to full-year 2015, when US investors accounted for 30% of investment into the region, at the start of the year those most active in the first quarter have been German investors, followed by local / regional investors (Polish, Czech or Slovak investors). South African funds have restated their interest for the region with record breaking transactions in Serbia and Montenegro, with more investments expected in other CEE countries over the course of the year.

Throughout the region prime yields have mostly remained stable compared to Q4 2015, with two major exceptions: Czech Republic and Poland, where a compression of 25 basis points was recorded for the office sector, which is now priced at 5.50%; a record low level for this current economic cycle. This comes on the back of high levels of interest from investors for core assets, of which there is a shortage of available product.

Russia registered a stellar quarter-on-quarter increase, with Q1 volumes reaching almost 60% of full 2015 volumes. The main driver for investors interested in Russia now is the potential of asset value recovery on the back of the market correction.