The Amsterdam office market is set to see further yield compression and rental growth on the back of continuing strong economic recovery in the Netherlands, delegates heard at PropertyEU’s Dutch Investment Opportunities briefing which was held at the Provada fair on Tuesday.

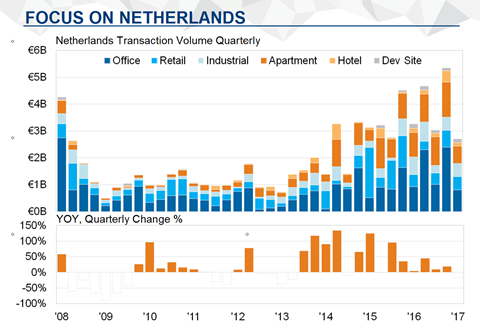

The Dutch capital is still 'cheap' compared to other global cities but office transaction yields – currently at just over 4% - have tightened by close to 200 bps in the last 12 months, according to figures presented by Simon Mallinson, managing director of EMEA & APAC at Real Capital Analytics (RCA).

Watch video highlights from the briefing

'The Netherlands is a positive story in an EU context and prices are still recovering,' Mallinson said. 'Amsterdam, which consistently features in the top 10 cities for investment in Europe, should see a lot more international money coming in,' he added. Asian capital in particular has been pouring into the Dutch capital recently, witness the Atrium office deal (€500 mln) in April and Hilton hotel deal (€350 mln) on the opening day of the Provada.

Coming from a trough in 2013-2014, commercial property prices in Amsterdam were slower to recover than other markets in Europe, the briefing heard. Although they are now 20% higher than their lows three years ago, there is still room for further rises.

A combination of sustained strong economic recovery, continued low interest rates and the expectation of a stable new centrist government in the Netherlands are set to drive demand for Dutch real estate further, the briefing heard.

'We expect a strong economic recovery going forward,' said Paul Oremus, country manager for the Netherlands at CBRE Global Investors. 'Office rents are increasing in Amsterdam’s prime business district Zuidas (South Axis), there is more tenant demand than supply,' he noted.

'All the economic numbers are good,' said Rogier Bos, head of real estate finance for the Benelux at German lender Berlin Hyp. 'GDP is on an upward trend and unemployment is falling, only spending power growth at 0.2% is a bit weak.’ Financing is readily available for investment transactions, but is limited for development, he noted. ‘The Netherlands has moved from a development to a redevelopment market, we are happy with that,' he noted.

Office conversions

Certainly in city centres in the western Randstad urban agglomeration, offices left empty following the credit crisis have been successfully converted to apartments or hotels, Oremus noted. ‘That is a positive signal. But office parks located along highways or outside the big cities are a different story and many are still vacant.’

Beyond the office sector, logistics and hotels have been gaining favour with investors with a number of big deals sealed in recent months. US private equity firm Blackstone purchased €438 mln of light industrial assets in the Netherlands together with M7 in Q1. In the hotel sector, Blackstone hit the headlines at end-May with news that it had sold the Doubletree by Hilton hotel in Amsterdam to Chinese investor Anbang for around €350 mln. Private equity firm HIG Capital is also looking keenly at hotel sector.

The retail sector, which has had a rough ride following a string of high-street bankruptcies since the crisis, remains somewhat risky but is attractive as a ‘core-plus, value add’ play, said Oremus. Residential property remains a 'safe harbour', certainly in the western Randstad region, although it is a 'challenge to find the right product', said Berlin Hyp's Bos.

Following parliamentary elections in March, the Netherlands is still waiting for a new government to be installed, likely to be a coalition of three to four parties. 'At Mipim in March, everyone was on tenterhooks about the outcome of the elections and a possible swing to the far right, but now that political risk has subsided,' said Dirk-Jan Gondrie, associate partner with law firm Dentons Boekel. The current coalition talks are expected to result in a broad centrist government which is stable and unlikely to change the regulatory and business environment, he added.

Brexit impact

Hopes of a major influx of financial services firms from London to Amsterdam following the UK’s Brexit vote last June have not translated into huge numbers of relocations, the briefing heard. 'There has been some movement to Amsterdam in the last 12 months but not what we had hoped for,' said CBRE GI's Oremus.

Japanese banking giant Mitsubishi UFJ Financial Group said last November it was upgrading its Amsterdam office to European headquarter status alongside London in the run-up to the UK's exit from the EU. But few have so far followed in its footsteps. According to Oremus, lower bonuses for investment bankers in Amsterdam compared to other European capitals are ‘blocking a big flow’ of firms relocating to the Dutch capital.