The number of new store openings by luxury brands is declining, but many companies are expanding their existing shops as luxury spending is on the rise again, according to a new Savills report which was presented at PropertyEU’s European Retail Investment Briefing in London on Friday.

There were 351 new luxury store openings this year, a 27% decline from the 2016 figure, but Europe has been increasing its share of the market from 36% to 38%, while Asia and the Middle East have booked declines. This reflects the trend among Asian - in particular Chinese - tourists of travelling to Europe’s main cities to do their shopping.

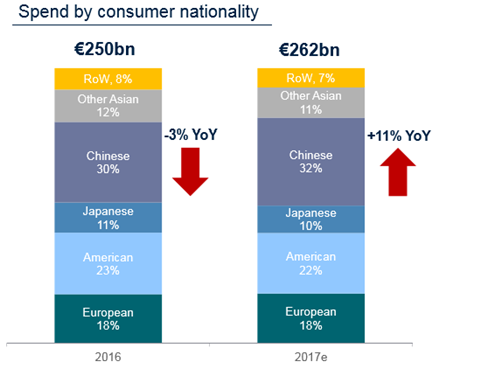

‘The decline in luxury spend in 2016 was driven by a softening in Chinese spending, but it has bounced back in 2017, increasing 11% to €262 bn,’ said Marie Hickey, director of retail and hospitality research at Savills.

Chinese biggest buyers of luxury goods

The Chinese are the single largest buyers of luxury goods, accounting for 30% of global spend, and they now do half of their shopping outside their domestic market, with European cities being a favourite destination.

‘Tourism will increasingly be the main driver of luxury shopping,’ said Hickey. ‘Europe will account for 43% of total global tourism, which is increasing. By 2025 the number of Chinese tourists visiting Europe will increase by 200% to 31 million. This will drive luxury spend in the main destination cities.’

Paris top luxury destination

According to The geography of luxury retail & opportunity markets for 2018 report, Paris has overtaken London to become the top global destination for luxury shopping, followed by Tokyo, Singapore and then London and Milan on an equal footing.

In Europe Paris is first, with London and Milan in joint second place, followed by Munich, Rome, Oslo, Florence, Frankfurt, Prague and Amsterdam. ‘These new destinations are appealing to investors because they attract more and more tourists but they also have affluent domestic populations as well as more affordable rents,’ said Hickey. ‘There are plenty of opportunities beyond London or Paris.’

Larger stores

In order to appeal to tourists and domestic buyers alike, 80% of new stores in Europe are in high-street locations. The other notable trend is for larger stores, with a 300 m2 average size in London, Paris and Milan, up from 100 m2, to have space for VIP facilities: ‘They are destination stores designed to impress,’ she said.

Transaction volumes in the sector are down 12% this year, according to Savills, but the downward trend should not be overplayed. ‘We are seeing a rationalisation of total store space, with a preference for large flagships in good locations. These shops are seen as an increasingly important place to drive online sales as well as increase brand awareness and improve customer engagement,’ said Hickey. ‘Actually selling a product in store becomes secondary.’

Extensions and refurbishments

Anthony Selwyn, head of central London retail at Savills, said that luxury brands are spending a lot of money on extending or refurbishing their stores. ‘In London and Paris 50% are relocations, the big groups pushing their emerging brands or aspirational brands going up a tier,’ he said.

The rebound in luxury spend ‘will translate into renewed occupational activity, but the focus will be on strategic and under-represented markets’, said Hickey. ‘We think the most interesting investment markets for 2018 will be Munich, Madrid and Barcelona.’