Slower economic growth in the euro-zone, as a result of the recent Brexit vote, will dampen rental growth somewhat. However, this will be more than counter-balanced by the positive impact on prime property yields of looser monetary policy, according to a study published by Capital Economics.

In the wake of the UK’s out vote, central bankers and politicians were quick to announce their willingness to support their economies. And, although equity markets suffered from investor panic initially, that response is already fading, with most of those losses having been reversed.

Indeed, the relatively relaxed response in global markets is partly due to the faith that central banks will do more to support economies and asset prices if required. 'We now expect that the ECB will increase the pace and duration of its asset purchases and that it may cut its deposit rate further too,' the research institute said.

There is still a risk of a knee-jerk reaction in property markets. In the UK a handful of fund managers have cut the prices of units in their open-ended fund vehicles and asked for weekly valuation updates from their valuers. But, in mainland Europe, there are conflicting factors that could affect commercial property capital values.

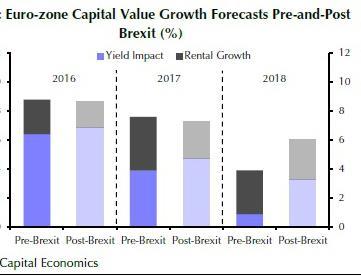

The market could be in for a period of slower rental value growth, reflecting a weaker growth environment, as indicated by the reductions in the euro-zone GDP forecasts. On the other hand, a more expansionary monetary policy environment is now widely expected.

Government bond yields have fallen markedly in the last 10 days, reflecting both a lower growth outlook and the likelihood of looser monetary policy. Regarded as a bond substitute in the last 5-6 years, prime commercial property stands to benefit once more from economic malaise in the region. Capital Economics' analysis suggests an improvement in the relative valuation of prime property since Q1. But, this doesn’t necessarily follow for secondary property, where risks to the income return are likely to be higher and investor demand for such property may therefore slow in the coming months.

Considering the overall effect on prime capital values from both occupier and investment markets, it is likely that the positive yield impact will, if anything, outweigh the negative affect of lower rental growth, the institute added.

'We are now pencilling in all property capital value growth of almost 25% between now and the end of 2018, 2-3% pts higher than our previous forecast.'