Investor spending on apartment and industrial properties combined took a greater value share of European commercial property transactions than offices for the first time last year, buttressing overall deal volume, Real Capital Analytics European Capital Trends 2020 report shows.

The pandemic-induced shift to working from home raised questions for investors over the future of offices, and property transactions in the sector fell by more than a third year-on-year. Offices are still, however, the single largest sector by total deal volume.

Total European investment volume fell 27% year-on-year to just under €255 bn in 2020, but deals plummeted 44% to €75.8 bn in the final quarter compared with the market’s all-time peak in the last three months of 2019.

Cross-border capital flows, both intra-regional and from investors in Asia Pacific and North America, retreated across Europe as travel restrictions and social distancing measures hampered the acquisition process. Liquidity in the vast majority of European markets dropped, though as yet pricing has mostly not taken a hit, with yields generally tracking sideways.

‘The shift towards ‘beds and sheds’ was one trend plenty had spoken of before March, but the impetus has redoubled in the face of the changes wrought by the Covid-19 pandemic,’ said Tom Leahy, RCA’s senior director of EMEA Analytics. ‘Apartment and industrial investment accounted for 37% of all European transaction activity by volume in 2020, which is a new record and greater than the amount spent on offices for the first time.’

Offices investment declined 35% in 2020 compared to 2019 with €94.2 bn of office properties changing hands over the year.

Tom Leahy added: ‘As yet, demand for core properties seems robust and pricing hasn’t changed substantively, but the real test will be when secondary and tertiary assets come to market.’

As a proportion of total market activity, sales out of distress totaled less than 1.2% in 2020. However, distress tends to lag the onset of the triggering crisis, and RCA expects to see more assets emerge in this fashion in 2021, focused on the sectors most at risk from the fallout of the pandemic – retail and hospitality.

The travel and leisure industry had a torrid year in 2020. Fewer hotels changed hands in 2020 than in any other year in RCA records, but some big hotel deals in the first quarter prevented the worst ever year for overall volumes. The full-year investment total tumbled 65%, with an 84% plunge in the final quarter.

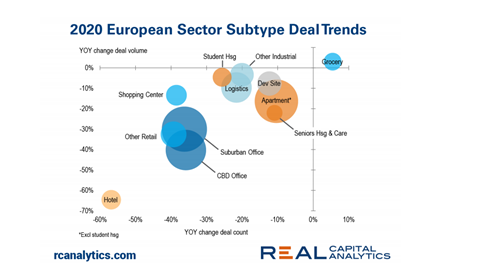

Retail was relegated to fourth place in the overall sector rankings for the first time ever with much of the market appearing to be off-limits for buyers and with little incentive for sellers to test the market. Grocery is the only retail subsector where transaction volume and deal count have increased from 2019. There will be an opportunity to repurpose a significant chunk of the existing built retail stock but, for now, RCA recorded just €700 mln of stores bought for conversion or demolition in 2020, equal to 2% of all retail trades in 2020.

Cross-border Capital Flows in Steep Decline

The biggest slowdown in cross-border capital flows last year was from US-based investors, the major source of overseas capital for European markets, with overall transactions down 38% versus 2019 to a seven-year low of €29 bn. Capital flows from Asia-headquartered investors, which had been prominent in several countries in Europe prior to the pandemic, fell by a half in 2020. Investment from South Korean investors plunged 78% to €2.7 bn from 2019’s record high level. The only Asian players to have largely maintained 2019 transaction volumes were the Singaporeans with deals totaling €4.3 bn completed in 2020, which is around €1 bn lower than the total for 2019.

Countries with a larger domestic base fared better overall in 2020 than those most dependent on cross-border investors such as Spain, Portugal and Ireland. Portugal was hit hardest by the exodus of US investors, with this cross-border flow plummeting 93%, followed by Spain with a contraction of 79% and Ireland reporting a fall of 45% in US flows.

German investors continue to spend overseas, and even though volumes were down somewhat in 2020, at minus 22%, this is less than the market as a whole. The number one European target was the UK and transaction volumes actually increased versus 2019. Allianz recently spent €447 mln buying a 75% share of a Central London office portfolio owned by British Land, augmenting other substantial acquisitions by Patrizia, Union, ECE and Dekabank.

The Top Buyers in the European market in 2020 were:

1. Blackstone

2. ADO Properties

3. Aroundtown

4. SBB i Norden

5. Union Investment