Aviva Investors' Lime Property Fund has agreed the forward-funding purchase of the redevelopment of Cardiff's former Custom House building into a Premier Inn hotel.

The volume of the acquisition from Cardiff-based developer Barola comes to £34 mln (€47 mln).

Pre-let to Premier Inn, the site is widely recognised as being the final piece of the Central Cardiff regeneration jigsaw that has seen the development of Central Square, Mill Lane and the Brewery Quarter, and the addition of St David’s 2 and will shortly see the redevelopment of Cardiff Central Station, which is 100 metres from the site.

The fund

Lime Property Fund is a secure income long-lease property fund managed by Aviva Investors with a net asset value of over £2 bn. The fund targets property investments let to strong tenants on leases with inflation-linked or fixed-rental uplifts and lease terms of 15 years-plus.

Kris McPhail, co-fund manager of the Lime Property Fund at Aviva Investors, added: 'We are very pleased to be working with Barola on this opportunity. This transaction provides our institutional clients with inflation-linked cash flow from a strong tenant and a property that is well located. These are exactly the type of investments we are actively targeting for the Lime Property Fund.'

Opening set for 2019

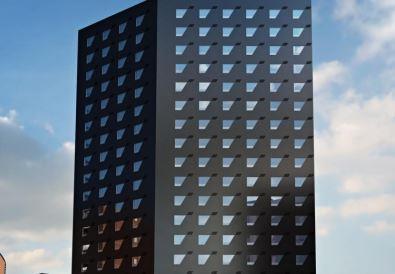

Planning consent for the new hotel was obtained in November 2017 and demolition of the former York Hotel and elements of Custom House is already underway. Construction of a 125,000 m2 GIA, 20-storey hotel and bar/restaurant retaining the Listed Custom House facades will start after Easter, with opening forecast for late 2019.

The Premier Inn hotel will provide 248 bedrooms over 17 floors, incorporating a Whitbread branded Bar & Block restaurant at ground and mezzanine levels fronting Custom House Street and St Mary Street. Premier Inn is taking a 30-year lease from completion of the building at a rent of £1.5 mln per annum. There is a tenant break in year 20 and Whitbread Group is guarantor.

Richard Talbot-Williams of BNP Paribas Real Estate acted jointly with Cushman & Wakefield for Barola.JLL represented Aviva Investors.