Aviva Investors, the global asset management business of Aviva, has published a new insights piece examining the risks and rewards of returning to work during the coronavirus pandemic.

According to Aviva, 'a return to ‘business as usual’, with companies operating again from their ‘normal’ locations, is a complex issue; one that real asset investors are following intently. 'Portfolio managers want to know which real asset markets are likely to return to work fastest to assess how quickly income generated on specific assets will recover,' the research notes.

However, the report also uncovers 'evidence that easing lockdown measures even slightly, without any accompanying containment plan, would accelerate the spread of Covid-19 to an unmanageable degree'.

The research suggests that in principle, it may be possible to ease some containment guidelines while 'retaining others, to keep the reproduction number of the virus below or very close to one'.

Benefits and risks

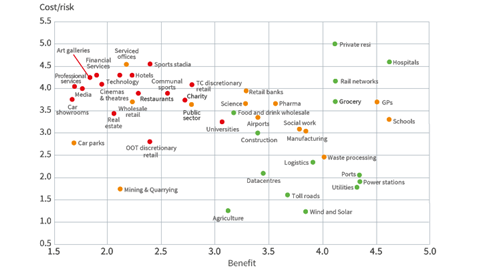

The research is displayed in a graph that ranks industry sectors relevant to European real assets investors by the benefits of returning to their usual workplace (shown on the x axis) against the risks of doing so (shown on the y axis).

According to the chart, there appear to be higher benefits to being open for 'utility-like' sectors favoured by infrastructure and long-income real estate investors – such as power, hospitals, schools – while the relative risks are lower.

Consequently, many of these sectors have remained open throughout the crisis (marked by green dots). Aviva said it expected other assets in these areas that have closed to reopen first.

Within infrastructure, transport assets will be among the most challenging to fully reopen while the pandemic persists. For example, it has been reported that London Underground could only operate at 15% of normal capacity to maintain effective social distancing; for buses this figure would be even lower at 12%. Similar challenges will apply to air travel.

In the waste sector, local authorities initially closed many household waste reuse and recycling centres; however, an increase in fly-tipping has highlighted their essential nature, leading the UK government to suggest they should reopen.

Traditional commercial real estate tenants

Meanwhile, traditional real estate tenants can typically be found in the top left of the chart; these are businesses that have been heavily impacted by the lockdown, but also face the highest risks to reopening.

Here, Aviva has placed discretionary retail and leisure tenants, as well as office occupiers in financial services and media, all of which have significant operational demands. 'The benefits to society of these sites reopening is low in the short-term given the options of shopping online or working remotely,' the report concludes.

The prospects are more positive for logistics and manufacturers of essential products. Although occupiers may be impacted by disruption to global supply chains and labour markets, people are more dependent on e-commerce during this period of enforced social isolation. This provides support for the sector now, but is a trend that is likely to continue long after Covid-19, according to the research.