Alaska Permanent Fund Corporation (APFC), a sovereign wealth fund with assets of $53 bn (€49 bn), has acquired a majority stake in the Intu Bromley shopping centre in London.

London-listed shopping centre landlord Intu Properties announced on Tuesday that APFC had agreed to acquire Intu's 63.5% stake. The agreed investment volume of £177.9 mln (€200 mln) represents a premium of about £2 mln to the June 2016 valuation. The topped-up net initial yield based on market value in June was 5.7%.

Separately, APFC also bought out the 21.5% interest held by Aviva Investors in the shopping centre. The price for this stake was not disclosed. The London Borough of Bromley has retained its 15% interest and the freehold. The centre will be managed by LaSalle Investment Management on behalf of APFC.

Completion of the transactions is expected before the end of the year.

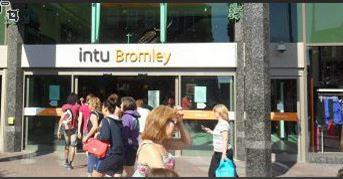

Intu Bromley is located in London's largest borough and has an annual footfall of 20 million.

Intu said in a statement that it had repositioned the asset through a refurbishment programme which 'improved the tenant mix of the centre'. The company added that the sale was in line with it's strategy of recycling capital into its £600 mln UK development pipeline. Proceeds fromt he sale will also be used to pay the current bank debt secured on the asset of £95.8 mln.

'We are pleased to have successfully concluded this transaction which enables us to recycle capital into our UK development programme focused on our super-regional assets and, at a consideration above our June 2016 market value, demonstrates the continuing investment demand for prime UK shopping centres,' Intu CEO David Fischel said.