All Real Assets articles in November/December 2025 (Magazine)

View all stories from this issue.

-

Special Reports

Special ReportsTop 10 real estate investment managers: Industrial

ESR leads with €107bn in assets globally

-

Special Reports

Special ReportsTop 10 real estate investment managers: Residential

MetLife leads with €87.7bn in assets globally

-

Special Reports

Special ReportsTop 10 real estate investment managers: Core

UBS AM leads with €142bn in assets globally

-

Special Reports

Special ReportsTop 10 real estate investment managers: Value-add

BGO leads with €32.4bn in assets globally

-

Special Reports

Special ReportsTop 10 real estate investment managers: Opportunistic

ESR leads with €43.6bn in assets globally

-

Special Reports

Special ReportsTop 10 real estate investment managers by region

Investors get very close to their targets

-

Special Reports

Special ReportsTop 10 real estate investment managers: Offices

PIMCO leads with €42.5bn in assets globally

-

Special Reports

Special ReportsTop 10 real estate investment managers: Retail

Nuveen leads with €21.8bn in assets globally

-

Special Reports

Special ReportsTop 10 real estate investment managers: Funds of funds and debt

UBS AM and MetLife lead with €48.6bn and €144bn, respectively

-

Special Reports

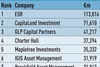

Special ReportsTop 150 Real Estate Investment Managers 2025: Lack of growth spurs M&A

Stagnation of AUM growth for the third year is helping to fuel a new wave of consolidation in the real estate investment management industry

-

Opinion Pieces

Opinion PiecesIPE Real Assets November/December 2025: A time for pragmatism

The uncertainty surrounding real estate and the wider world – from geopolitical tensions, political unpredictability, protectionism, technological disruption and physical climate risk – is here to stay, at least for the foreseeable future.

-

Interviews

InterviewsJessica Hardman on branching out with Aboria

The former DWS UK CEO tells Richard Lowe about the journey of launching a vertically integrated real estate fund manager

-

Interviews

InterviewsSophie van Oosterom on a more active and collaborative approach to real estate

The global head of real estate at CPP Investments talks to Richard Lowe after less than 12 months in the role

-

Analysis

AnalysisHotel investment activity remains brisk in parts of Asia as tourism numbers swell

Wealthy individuals emerging as increasingly active buyers in the region

-

Special Reports

Special ReportsSovereignty concerns add to the risks surrounding the data centre boom

Florence Chong examines what the risks around data sovereignty means for infrastructure investors

-

Analysis

AnalysisAre investors right to allocate billions of dollars to AI infrastructure?

Florence Chong explores whether the rush into data centres is a safe bet or vulnerable to a tech bubble

-

Analysis

AnalysisTime for takeoff: Global race to build the next generation of airports

Airports worldwide are rushing to invest in innovation and technology to prepare for the anticipated surge in plane travel in a net-zero era

-

Special Reports

Special ReportsDeglobalisation - Playing defence in Europe: Opportunities for real assets investors

Will European remilitarisation create opportunities for institutional investors? Christopher Walker investigates

-

Special Reports

Special ReportsThe great transatlantic divide: US versus European real assets

As deglobalisation takes hold, Christopher Walker examines the relative attractions of Europe and the US for real assets investors

-

Analysis

AnalysisAustralian funds split over US-style redemption rules

High-profile grapple over Lendlease-managed funds highlights broader structural tensions in A$68bn sector