All Real Assets articles in November/December 2023 (Magazine)

View all stories from this issue.

-

Special Reports

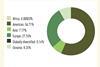

Special ReportsTop 150 RE managers 2023: Top 10 breakdowns by geography, sector, strategy and more

Top 10 by geography and sector Real estate AUM – Global Company €m 1 Blackstone 305,947 2 Brookfield Asset Management 254,010 3 MetLife Investment Management 175,802 4 PGIM Real Estate 147,559 5 ...

-

Special Reports

Special ReportsTop 150 Real Estate Investment Managers 2023

The AUM growth of the Top 150 has turned negative for the first time in 10 years. Maha Khan Phillips explores what is happening

-

Special Reports

Special ReportsHow the Top 150 RE managers performed according to GRESB

The Top 150 outperforms the broader market on ESG, according to global benchmark GRESB

-

Analysis

AnalysisIPE Real Assets November/December 2023: RE AUM growth turns negative

When IPE Real Assets surveyed institutional investors about their real estate allocations in April this year, it became clear that a slowdown had started. Real estate had been one of the most favoured asset classes during a decade of low interest rates.

-

Interviews

InterviewsLocal Pensions Partnership Investments: The benefits of scale in action

LPPI was formed in 2016 to help aggregate local authority pension fund money. Today, it manages some £5bn in infrastructure

-

Interviews

InterviewsL&G's Bill Hughes: Real estate sector evolves from passive rent collector to active impact investor

Has the real estate industry evolved to such an extent it can be a ‘force for good’? Interview by Richard Lowe

-

Magazine

MagazineAI and the built environment

Institutional investors are beginning to explore what AI can bring to their real estate allocations. Pirkko Juntunen reports

-

Analysis

AnalysisAnalysis: The demise of UK property funds?

The news that M&G would wind up its flagship vehicle prompts questions about the viability of the open-ended funds in the UK. By Richard Lowe

-

Special Reports

Special ReportsOpportunistic real estate: An avenue of growth for fund managers?

As interest rates and repricing weigh on fundraising and AUMs, the industry looks to opportunistic real estate as a potential way to grow AUM. Christopher Walker reports

-

Special Reports

Special ReportsWhy hard-to-abate aviation sector must not stall on decarbonisation efforts

Aviation is behind other transport sectors on decarbonisation, but this is because of unique challenges, writes Florence Chong

-

Special Reports

Special ReportsSwiss Life helps reduce emissions by backing road-by-rail concept

Christoph Manser tells Florence Chong about investing in Helrom’s trailer wagons

-

Magazine

MagazineBiodiversity and the built environment

In the third of a series of biodiversity articles, John Fernández and Thomas Wiegelmann highlight strategies that real estate investors can deploy on plots of land, buildings or neighbourhoods

-

Magazine

MagazineInfrastructure in the blender: combing private and listed markets

Fraser Hughers and John Creswell make the case for building an infrastructure allocation using both private and listed markets

-

Special Reports

Special ReportsCBRE IM seeks to decarbonise ports on both land and water

Stephen Dowd talks to Florence Chong about its transport decarbonisation efforts

-

Magazine

MagazineDEI and the built environment

The real estate industry needs to consider DEI – not only in terms of its workforce but also the space it builds. Maha Khan Phillips reports

-

Special Reports

Special ReportsWhy roads present the most important challenge in decarbonising transport

Investors need lofty ambitions for the highway, writes Florence Chong

-

Special Reports

Special ReportsSea change: Is shipping on the verge of a decarbonisation transformation?

The maritime industry could be on the verge of a transformation. Florence Chong reports

-

Special Reports

Special ReportsMacquarie green investments team gets fully charged in EV infrastructure

Chris Archer talks to Florence Chong about Macquarie’s acceleration into the EV charging sectors

-

Special Reports

Special ReportsRail's crucial role in decarbonising global transport sector

As trains are the most sustainable form of transport, the real challenge is to increase their use. Florence Chong reports

-

Special Reports

Special ReportsDecarbonising transport: Can investors keep up with the growth of the sector?

Progress is being made to decarbonise global transport, but it will need to keep up with the rapid expansion of the sector, writes Florence Chong