Real estate credit and special situations investment manager Zenzic Capital has set up a UK student housing strategy, seeking to invest more than £500m (€582m).

Zenzic said it has launched the purpose-built student accommodation (PBSA) venture which has been seeded with the acquisition of five major schemes with a total gross development value of over £147m through a joint venture with residential developer Torsion Group.

The partnership with Leeds-based Torsion targets a total portfolio with a gross development value of over £250m across seven schemes by the end of 2024, Zenzic said.

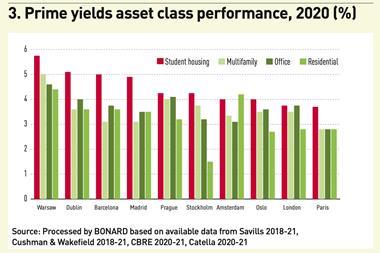

Nadine Buckland, CEO of Zenzic Capital, said: “The UK student accommodation sector is underpinned by a number of highly attractive tailwinds, including growing student numbers, an acute shortage of high-quality supply and an inflation-protected income profile that enhances returns for our investors against a challenging wider macroeconomic backdrop.

“We have already established a strong track record in the PBSA market, and this strategy enables us to increase our exposure to a sector that is one of our most compelling conviction calls.

“As part of this strategy, we look forward to building on our longstanding relationship with Torsion through this joint venture as we work together to deliver a best-in-class, sustainable product that meets the needs of modern students.”

Dan Spencer, CEO of Torsion Group, said: “The partnership gives us a strong foundation to scale and accelerate our growth in the PBSA sector. We are actively taking measures to reduce our embodied carbon emissions on all our developments.

“That is because sustainability remains at the forefront of our strategy and decision-making as we look to play a leading role in delivering decarbonisation across the construction sector.”

To read the latest IPE Real Assets magazine click here.