Tacoma Employees’ Retirement System has made a $100m (€98m) commitment to the IDR Core Property Index Fund.

Tim Allen, Tacoma Employees’ Retirement System’s CIO, said: “Tacoma Employees prefers passive mandates for a significant portion of our overall investment portfolio. The investment approach by IDR met several requirements in terms of cost, transparency and predictability of returns.”

With the investment in the Core Index Fund, the pension fund now has more than 33% of its total portfolio in passive allocations.

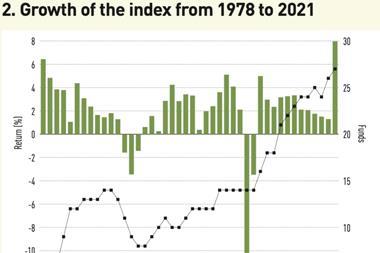

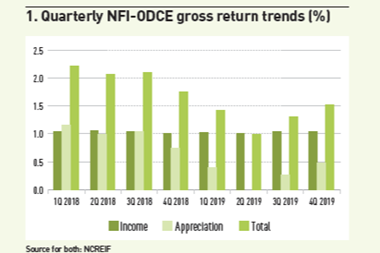

The Core Index Fund managed by IDR Investment Management invests in all funds that make up the NCREIF Open-end Diversified Core Equity index, which is capitalised by more than 4,000 global investors with around 3,300 properties across 35 US markets.

The fund raised more than $650m from institutional investors during the first half of 2022, according to sources.

The commitment by Tacoma Employees completes the pension fund’s plan to achieve a 10% strategic asset allocation to private core real estate. Tacoma Employees already has a $130.2m investment in the Invesco Core Real Estate Fund.

The pension fund also has a $76.1m US real estate investment trust portfolio managed by Adelante Capital Management.

To read the latest edition of the latest IPE Real Assets magazine click here.