RoundShield has secured over $1bn (€920m) for its latest European asset-backed special situations and distressed opportunities fund.

The private investment firm said the amount raised for its RS Fund V fund at close was nearly $150m above its fundraising target.

As previously reported, Fund V had an €800m target and a €950m hard cap. The manager’s previous fund in the series, Fund IV, closed at its £670m hard cap in March 2020.

RoundShield said the fund received commitments from existing investors in its earlier vintage funds, as well as 10 new investors, including public and private pension funds, endowments and foundations, insurance companies and large family offices globally.

Over 80% of the investors in Fund V invested in a prior RoundShield fund, the manager added.

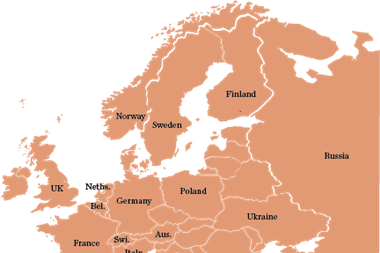

Fund V – categorised as an Article 8 product under the EU Sustainable Finance Disclosure Regulation – invests in asset-backed private credit, primarily focusing on real asset sectors in Western Europe, including hospitality, student housing, residential, social infrastructure, renewable energy and other operating-related real estate.

Driss Benkirane, founder and managing partner of RoundShield said: “This fundraising milestone underscores our investors’ confidence in our experience and in our ability to deliver attractive risk-adjusted returns through economic cycles.

“We believe that European real assets private credit is a very attractive sub-category of private credit, especially within the highly fragmented mid-sized deal universe where we invest. Today’s opportunity set is particularly attractive due to the lack of liquidity in the European mid-market, real estate valuations that continue to adjust to the higher interest-rate environment and shifts in real estate usage post pandemic.”

To read the latest IPE Real Assets magazine click here.