The modest recovery in UK commercial real estate values in March and April are expected to be “a temporary reprieve” and will be followed by further falls, according to Oxford Economics.

The economic forecasting firm has warned that stubbornly high inflation in the UK has raised the risk of financial distress in the sector and is predicting commercial property values to fall further 8% by the end of the year.

Oxford Economics is now predicting that the Bank of England’s base rate will peak at 5% – up from its previous prediction of 4.5% – and the central bank will only begin cutting interest rates in early 2025, rather than Q2 2024.

In a research briefing, the firm said: “This meaningful increase in the cost of debt raises the risk of commercial real estate distress as interest coverage ratios fall further, particularly concerning for those with higher loan-to-value ratios and fixed-rate loans maturing this year and in 2024.”

Oxford Economics downgraded its outlook for UK real estate March. In an update this week, it said it maintained its “below consensus forecast” of a further 8% fall in all-property capital values, and growth of just 0.4% in 2024.

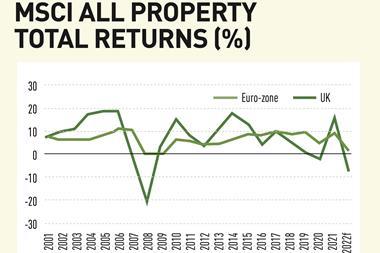

Latest figures from MSCI suggests all real estate sectors except for offices saw month-on-month capital growth in March and April. But Oxford Economics warned: “We think this is a temporary reprieve with further falls to come as tighter credit conditions, rock-bottom sentiment, inadequate risk premia and high debt costs all continue to weigh on the outlook.

Offices are expected to see the biggest falls in values, with Oxford Economics estimating that “much of this fall in values has already occurred for industrial assets”.

The UK industrial property sector experienced its severest correction ever in the second half of last year.

To read the latest edition of the latest IPE Real Assets magazine click here.