XpFibre, a French fibre business backed by Altice, Canadian pension fund OMERS, German insurer Allianz and French fund manager AXA IM Alts, has secured €5.8bn in credit facilities from institutional creditors and infrastructure bank lenders.

OMERS said the financing, which was designed to achieve an investment grade rating from S&P and DBRS, attracted both European and US investors.

The names and specific contributions of the individual investors were not disclosed.

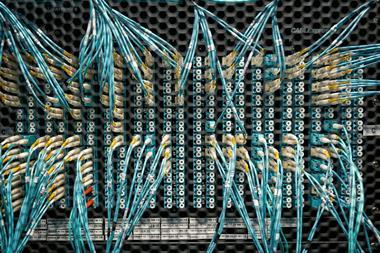

XpFibre is the largest independent fibre-to-the-home (FTTH) operator in France, delivering high-speed internet to approximately 25% of the French territory in terms of homes passed.

Alastair Hall, head of Europe at OMERS Infrastructure, said: “This refinancing is a vote of confidence in the strength of XpFibre. As the company’s rollout phase nears completion, now is the right time to put in place a capital structure that reflects XpFibre’s highly resilient business model, predictable cash flow and robust financial profile as well as supporting its continued rollout to customers.”

In the latter part of 2018, a consortium led by OMERS Infrastructure, together with Allianz and AXA IM Alts, agreed to buy a 49.99% stake in SFR FTTH, the fibre business of telecoms group Altice France for €1.8bn.

SFR FTTH was a newly formed company by Altice France which was to hold and further develop Altice France’s existing FTTH business in France.

Altice France remained a shareholder majority of SFR FTTH, which became XpFibre on 30 March 2021.

To read the latest IPE Real Assets magazine click here.