Global investment manager GLP has expanded its European presence to 10 countries with the acquisition of Goodman Group’s Central and Eastern Europe (CEE) logistics portfolio for €1bn (A$1.7bn).

GLP, which entered Europe in October 2017 with the €2.4bn Gazeley acquisition, has now added Goodman’s 2.4m sqm portfolio spread across Poland, the Czech Republic, Slovakia and Hungary to its existing assets spread across the UK, Germany, France, Spain, Italy, Poland and the Netherlands.

The deal, which is subject to regulatory approval, also includes Goodman CEE team of 40 joining GLP’s European team.

Nick Cook, Gazeley CEO, said: “The scale and geographic footprint of the portfolio is highly complementary to our existing business and offers us compelling opportunities for growth in a number of important European markets.

“We are confident that the addition of this portfolio will support us in delivering further value to investors and our customers. We very much look forward to welcoming the team, its customers and partners to Gazeley in the coming months.”

For Goodman, the sale is part of its strategy to focus on gateway cities and major urban consumer markets in continental Europe.

Greg Goodman, Goodman’s group CEO, told IPE Real Assets the group was increasing its development projects in Europe, in markets such as Barcelona and Madrid in Spain and Hamburg in Germany.

“We are not doing large broadacre projects in Europe,” he said. “We are building high-value last-mile facilities in key cities close to consumers.”

This is the group’s core strategy in all of its markets.

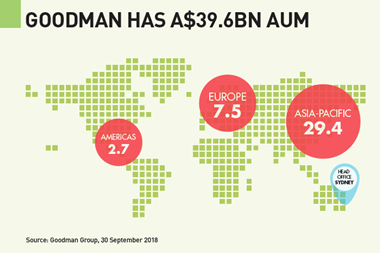

Goodman said the group was on track to lift its work in progress to more than A$5bn in the current financial year, and that Europe’s share of development projects would be “substantial”.

“Certainly in the A$800-A$900m range,” he told IPE Real Assets.