A report by the Long-Term Infrastructure Investors Association (LTIIA) has shown that institutional investment in the energy transition is gaining momentum, but also warns that investors are taking on more risk in relation to renewable energy.

The Energy Transition: Implications for Infrastructure Investors report, published in partnership with the Global AWM & ESG Market Research Centre at PwC Luxembourg, predicts that 61% of global energy investments in 2023 will be directed towards renewable energy, nuclear power, electric vehicles and energy efficiency.

The report also observes that renewable-energy technology is becoming more cost competitive, the regulatory landscape is evolving and incentives are being removed, “which brings forth both potential risks and new opportunities, such as the ability to earn revenues on the balancing market by reducing production”.

The report says: “The emerging risks have yet to be reflected in the investors’ return requirements and their business models.”

The LTIIA has also provided recommendations for policymakers and governmental authorities, regulatory authorities, investors and fund managers, covering the need for roadmaps and commitments, public financial support when technology or market risks are too high, adapted sectoral and prudential regulations, and enhancing technical and market expertise for fund managers.

Beyond financing renewable energy ventures, investors can also contribute – particularly in social infrastructure – to educating end-users on the responsible management of their energy consumption, according to the report.

Vincent Levita, chair of the LTIIA, said: “The energy transition, with its immense significance and far-reaching implications, stands as the linchpin in our collective efforts to combat climate change and forge a path towards a cleaner, greener, and more resilient world.

“It has come to the forefront of our collective consciousness in this pivotal moment, as it is one of the main resources at our disposal to significantly bring down greenhouse gas emissions and reach net zero by 2050. The world’s energy landscape must be reshaped urgently, as it is no longer just a policy option but a necessity.

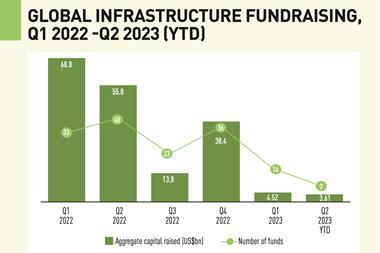

Francois Bergere, executive director at the LTIIA, said: “Despite the continuous growth in global infrastructure investments supporting the energy transition, net-zero goals remain challenging to attain, and we have yet to align with the necessary path to reach them.

“Governments cannot bear the financial burden of the energy transition on their own, making it even more crucial for the private sector to bridge the investment gaps.”

To read the latest edition of the latest IPE Real Assets magazine click here.