Australian real estate investment trust Dexus has exercised its put option to sell its remaining 25% interest in a Sydney office tower to the Charter Hall Group for A$157.5m (€96m).

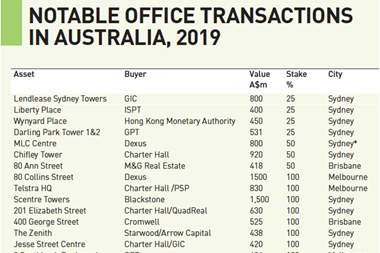

Charter Hall and its partner, Abacus, bought a 75% stake in the 34-level building in Elizabeth Street, jointly owned by Dexus and Australian investment firm Perron Group in 2019.

At the time of the transaction, which valued the total deal at A$630m, Dexus held back a 25% stake, subject to a put-and-call option expiring at the end of October this year.

A Dexus source told IPE Real Assets there was no time limit to the option, but Dexus had chosen to exercise it now to realise a trading profit of A$34m.

Dexus has also sold a portfolio of five industrial properties, located in Victoria to its 51-49 joint venture with GIC, known as the Dexus Australian Logistics Trust (DALT), for A$269.4m.

Darren Steinberg, CEO of Dexus, said: “We are pleased to have been able to retain exposure to these quality industrial assets via our interest in DALT while contracting a trading profit for Dexus investors.”

To read the digital edition of the latest IPE Real Assets magazine click here.