A private fund managed by BlackRock has acquired a 50% stake in an office and retail asset in a northern Sydney suburb for A$120m (€72m) from Cromwell Property Group.

Simultaneously, BlackRock has entered a joint venture with Cromwell to add more space to the 475 Victoria Avenue asset, including an office tower and further amenities which could cost A$85-A$90m.

Paul Weightman, Cromwell’s CEO, told IPE Real Assets that Cromwell already had development approval for the site, to include a hotel.

Weightman said the plan would be “tweaked”. He expected further feasibility to be completed, and work to start on the expansion within 12 months.

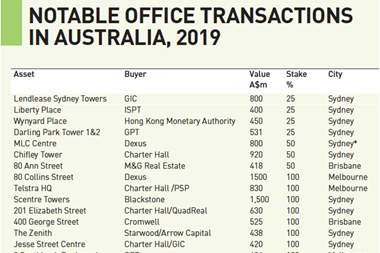

BlackRock is familiar with Chatswood, having earlier formed a joint venture with Centuria Group to buy Zenith Towers for $279m in 2016. The partners sold Zenith Towers to Starwood Capital last year for $438.2m.

Hamish MacDonald, head of investments for BlackRock APAC Real Estate, said the firm was pleased to partner with Cromwell, and to be able to leverage its “extensive experience” investing in Sydney’s North Shore office market.

“Local infrastructure investment, including the new Sydney Metro line connecting Chatswood with Sydney CBD, is facilitating positive market transition,” he said.

Coupled with population-led demand and yield spread to borrowing costs, he said Australia was an attractive market for BlackRock Real Estate to continue to invest in on behalf of its long-term investors.

MacDonald signalled the possibility of expanding his firm’s relationship with Cromwell on future opportunities.

The Chatswood project is part of Cromwell’s A$1.2bn value-add development pipeline in Australia.

Weightman said the Cromwell group also had a very strong pipeline in Europe and planned to roll assets either into its Singapore-listed Cromwell European REIT or to seed new funds, possibly to be listed in Singapore.