APG, through its partnership with Aquila Capital, has committed a further €250m to Norwegian hydropower company Småkraft.

The latest investment, which increases the €538bn Dutch pension fund manager’s investment in Småkraft to €550m, will help expand the company’s portfolio of small-scale hydropower plants.

Aquila bought Småkraft on behalf of its investors in 2015. APG, investing on behalf of Dutch pension fund ABP, is the majority shareholder of Småkraft.

APG said the additional capital enables Småkraft to expand its portfolio of small-scale hydropower plants in Norway and enables the construction of 10 new small-scale hydropower plants every year, increasing the generation of renewables by 130GWh per year.

Patrick Kanters, managing director global real assets at APG, said: “As a pension investor, we are continuously looking for attractive infrastructure investments worldwide that help us realise long-term and responsible returns for ABP and other pension fund clients we work for.”

Kanters said APG has over the last years made progress in realising its pension fund clients’ stated ambitions in the areas of sustainability and responsible investment.

At the end of 2019, APG had €5.8bn invested in renewable energy, he said.

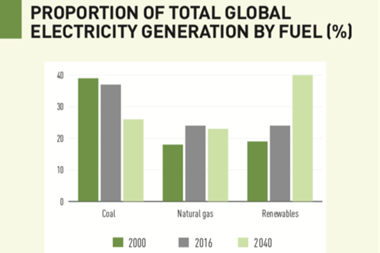

“By increasing our commitment to Småkraft, we are enabling the European energy transition from fossil fuels and contribute to reducing carbon emissions, in line with the ambitions of our pension fund clients.

“Aquila Capital, with its on-the-ground knowledge and recognised track record on hydro, has proven to be a strong partner for APG.”

Roman Rosslenbroich, CEO and co-founder of Aquila Capital, said: “We are delighted to expand the partnership with APG to support Småkraft to grow in the years to come.

“As we increase the share of renewables in Europe, Norwegian hydropower and the building of interconnections to other countries play a vital role to bring stability to the electricity grid.”