Sweden’s AMF, Canada Pension Plan Investment Board (CPP Investments), and Ontario Municipal Employees Retirement System (OMERS) were among institutional investors backing a financing round extension for Swedish battery maker Northvolt.

Northvolt said it had raised $1.2bn (€1.1bn) to finance plans for its further European and North American expansion, with the funding an extension of a $1.1bn convertible note signed in July 2022.

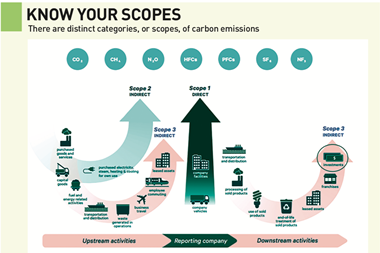

Northvolt said the convertible debt issue had attracted investment from funds labeled dark green in accordance with Article 9 of the EU’s Sustainable Finance Disclosure Regulation.

The firm said this latest financing round had been led by CPP Investments, OMERS, the Investment Management Corporation of Ontario (IMCO) and BlackRock.

From Stockholm, AMF announced that it had invested around SEK220m (€18.5m) in Northvolt, having previously invested approximately SEK1.8bn in the firm.

Anders Oscarsson, head of equities and responsible ownership at AMF, said: “We appreciate the opportunity to strengthen our investment in Northvolt.

“We joined the company’s exciting journey at an early stage and have been impressed time and time again by how quickly it has grown and developed from an idea, to delivering concrete solutions that contribute to society being able to change,” Oscarsson said.

Separately, IMCO said back in June that it was investing $400m in Northvolt.

Northvolt said that up to now, investors in what has now become a $2.3bn convertible round had included Goldman Sachs Asset Management, AP funds 1-4 via the co-owned company 4 to 1 Investments, Folksam Group, ATP, Volkswagen Group, AMF, Ava Investors, IMAS Foundation, Baillie Gifford, Swedbank Robur, PCS Holding, Olympia Group, TM Capital, Compagnia di San Paolo through Fondaco Growth, East Innovate, ADQ, GIC, Chow Tai Fook Enterprises and J. Safra Sarasin.

“With this capital raise, Northvolt has now secured over $9bn in equity and debt to deliver on over $55bn in orders from key customers, including BMW, Fluence, Scania, Volvo Cars and Volkswagen Group,” the firm said.

To read the latest edition of IPE Real Assets magazine click here.

Topics

- AMF

- AP1

- AP2

- AP3

- AP4

- ATP

- BlackRock

- Canada Pension Plan Investment Board

- Canadian Investors

- Capital Raising

- convertible debt

- CPP Investments

- Energy Infrastructure

- Folksam

- Goldman Sachs Asset Management

- IMCO

- Investors

- Northvolt

- OMERS

- Ontario Municipal Employees Retirement System

- Pension Funds

- Swedish Investors

- Volkswagen Group