Latest reports – Page 282

-

PropertyEU Archive

PropertyEU ArchiveRedevco and Ares put €250m Madrid shopping centre up for sale - report

Landlords Redevco and Ares have reportedly appointed advisor Cushman & Wakefield to manage the sale of Parque Corredor, a 123,000 m2 shopping centre located in Torrejón de Ardoz, northeast of Madrid.

-

PropertyEU Archive

PropertyEU ArchiveIvanhoé Cambridge secures planning for major London mixed-use revamp

Landlord Ivanhoé Cambridge has secured approval for a major redevelopment of 21 Lombard Street in London.

-

PropertyEU Archive

PropertyEU ArchiveCPP Investments partners with Kennedy Wilson to launch €1.2b UK single-family rental housing JV

Canada Pension Plan Investment Board (CPP Investments) has partnered with global real estate investment company Kennedy Wilson to launch a new single-family rental housing joint venture in the UK.

-

PropertyEU Archive

PropertyEU ArchiveHillwood wins €38m loan for new Polish logistics park

US-based group Hillwood's Polish arm has secured a €38 mln financing from mBank for the construction of the Hillwood Zgierz II logistics park in central Poland.

-

PropertyEU Archive

PropertyEU ArchiveStarwood Capital and pbb join forces in new CRE lending strategy

Global private investment firm Starwood Capital is teaming up with German lender Deutsche Pfandbriefbank (pbb) to launch a new strategic partnership in CRE lending.

-

PropertyEU Archive

PropertyEU ArchiveNiam acquires 203 rental apartments in Stockholm from Citycon

Nordic private equity firm Niam has acquired 203 rental apartments in the fast-growing district of Barkarbystaden, located in Järfälla municipality, north of Stockholm.

-

PropertyEU Archive

PropertyEU ArchiveInvel secures €34m loan for Rome redevelopment

Invel Real Estate has secured a €34 mln financing facility from Italian lender BPM to redevelop an office-led building in Rome into 150 apartments.

-

News

NewsPeople moves: Wallace joins CBRE IM private infrastructure strategy team into APAC

Enfinity Global appoints Helmrich global head of operations

-

News

NewsCube Infrastructure sells Danish bus network operator Umove to JP Morgan

Umove operates a fleet of over 850 buses

-

News

NewsPGIM and Citymark to invest $500m in US apartment loans

Pair team up to deploy capital for the acquisition of senior loans or other structured positions

-

News

NewsAPG and Swiss pension funds partner for €1bn infrastructure investment

Publica, City of Zurich, Kanton Aargau and Credit Suisse join APG in infra equity investment venture

-

News

NewsSROA Capital secures $930m for US self-storage investments

San Joaquin County Retirement commits $50m to SROA Capital Fund IX

-

News

NewsTERS transfers capital from Invesco real estate fund to IDR index vehicle

TERS is already an investor in the IDR fund

-

News

NewsI Squared to buy Philippines Coastal Storage in $460m deal

Keppel Infrastructure and Metro Pacific to sell their respective 50% equity stakes

-

News

NewsBKM recapitalises Wier Thirty6 Business Park in Phoenix

Asset initially acquired in 2018 for $8m sells for $22m

-

PropertyEU Archive

PropertyEU ArchiveBritish Land appoints COO as finance chief

British Land has appointed David Walker as its new chief financial officer, taking over from Bhavesh Mistry who steps down on 20 November.

-

PropertyEU Archive

PropertyEU ArchiveLuxury real estate continues to outperform, fuelled by growing affluence and demographics

A new report from CBRE suggests that the luxury segment of the European retail, hotel and living sectors will continue to outperform the mass market, driving the prices and rents of the underlying real estate.

-

PropertyEU Archive

PropertyEU ArchiveTriOffice acquires Manchester asset in maiden deal

TriOffice, the office investment arm of UK value-add real estate investor and asset manager Tri7 Group, has struck its first deal with the acquisition of an asset in Manchester in a joint venture with The Pears Group.

-

PropertyEU Archive

PropertyEU ArchiveAquila logistics fund acquires second asset in Portugal

Aquila Capital Southern European Logistics (ACSEL), an open-ended investment fund targeting newly built and ESG-compliant logistics properties in Italy, Spain and Portugal, has expanded its portfolio with the acquisition of an asset in Gandra, Greater Porto.

-

PropertyEU Archive

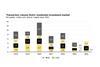

PropertyEU ArchiveDutch residential volumes up again in Q3, but new-build investment still short of target

Investment in the Dutch residential market totalled €2.3 bn in the third quarter of 2024, bringing transaction volumes for the first nine months of the year to €5 bn, more than double the year-earlier figure, according to research from advisor Capital Value.