All Real Assets articles in January/February 2024 (Magazine)

View all stories from this issue.

-

Special Reports

Special ReportsBVK: German pension fund with 15 years’ experience in timber

Kathrin Kalau-Reus tells Luigi Serenelli that the asset class will become more expensive

-

Analysis

AnalysisIPE Real Assets January/February 2024: Natural capital sees growth as real estate wilts

The outlook for real estate markets in 2024 is mixed, at best. The hope is it won’t be as bad as last year, when the asset class experienced varying degrees of repricing across the globe. As Tom Leahy, head of EMEA real assets at MSCI Real Estate Research, quips, “2023 has not exactly been a vintage year for real estate”.

-

Special Reports

Special ReportsRest: Super fund cultivates 25-year-old agriculture portfolio

Simon Esposito tells Florence Chong how the asset class was the highest performer in 2023

-

Special Reports

Special ReportsTop 25 natural capital fund managers: Fertile ground for innovation

Timber and agriculture fund managers are growing, but they are also evolving to incorporate new revenue streams such as renewable energy and carbon credits. Florence Chong reports

-

Special Reports

Special ReportsBTG Pactual TIG: Americas timber specialist has high hopes after COP28

Caitlin Clarke talks to Razak Musah Baba about Brazil, reforestation and carbon markets

-

Special Reports

Special ReportsTop 50 natural capital investors

The 50 largest natural capital investors are dominated by North American institutions. Richard Lowe and Tjibbe Hoekstra report

-

Special Reports

Special ReportsAffordable housing: ABP and bpfBOUW team up for impact

Dutch pension funds have committed €400m to a fund to improve housing affordability in their domestic market. Razak Musah Baba reports

-

Special Reports

Special ReportsNew Forests: Japanese money to accelerate forestry pioneer’s ambitions

CEO Mark Rogers tells Florence Chong about the move to ‘landscape’ strategies

-

Special Reports

Special ReportsGresham House: Accelerating ambitions under new owners

Tony Dalwood talks to Richard Lowe about the Searchlight takeover and the future of natural capital

-

Special Reports

Special ReportsAffordable housing: Scotland prompts the law of unintended consequences

Well-intentioned initiatives by the Scottish government to control rents have backfired, with knock-on effects for student housing. Christopher Walker reports

-

Special Reports

Special ReportsAffordable housing: PGIM seeks to serve the ‘forgotten majority’

Oscar Kingsbury tells Christopher Walker why PGIM has a laser focus on single-family affordable homes in the UK

-

Special Reports

Special ReportsGuest view: It’s a myth that build-to-rent does not work for affordable housing

Controlled rents do not equal underperformance – the truth is the opposite, writes Alex Lund

-

Special Reports

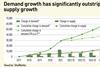

Special ReportsCan institutional investment in affordable housing keep up with demand?

Institutional investors have been homing in on affordable housing. But the need is only growing stronger. Christopher Walker reports

-

Special Reports

Special ReportsWhat the biodiversity agenda means for forestry and agriculture

Biodiversity is rising up the agenda of institutional investors. Christopher Walker explores what it means for forestry and agriculture

-

Special Reports

Special ReportsManulife IM: Timber giant with growth plans for agriculture

Florence Chong talks to the largest firm in our Top 25 ranking

-

Special Reports

Special ReportsQIC: Private markets giant turns to local agriculture

Tom Murphy tells Florence Chong about the huge domestic opportunity for the state investor

-

Special Reports

Special ReportsGothaer: German insurer opts for natural capital allocation

Institution begins building exposure by investing in Article 9 funds, writes Luigi Serenelli

-

Special Reports

Special ReportsPGIM: Historical farmland lender with modern ambitions

Jamie Shen tells Florence Chong about expanding a business dating back to the 1880s

-

Special Reports

Special ReportsAnalysis: Banking on a private debt boon

Fund managers have been positioning themselves for a private debt expansion. Lauren Mills asks are they right and will 2024 be a golden year for institutional lending?

-

Opinion Pieces

Opinion PiecesGuest view: Infrastructure asset class takes on central role in energy transition

Infrastructure investors are ready to turbocharge the energy transition, writes François Bergère