A new $5bn (€4.05bn) global infrastructure fund set up by US private equity giant KKR, has received backing from Minnesota State Board of Investment (SBI).

KKR did not comment, but a board meeting report said Minnesota SBI had approved a $150m commitment to the fund.

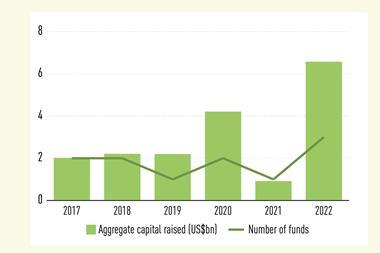

Sources that track fundraising of infrastructure managers, say KKR is targeting a $5bn for KKR Global Infrastructure III.

As reported by IPE Real Assets, KKR raised $3.1bn for KKR Global Infrastructure Investors II in 2015.

Infrastructure III will invest in core, income-producing infrastructure assets globally, with a focus on North America and Europe. Sectors will include social, distribution and storage, transportation and utilities.

It will be the first time that KKR has been hired by Minnesota SBI.

The investment will add to the pension fund’s real assets portfolio, which was valued at close to $4bn at the end of last year.

Minnesota SBI currently employs 10 real assets managers and has made 36 individual investments.