European investors need to

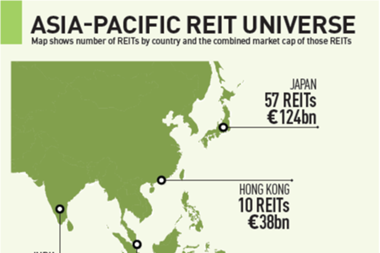

European institutional investors are increasing their exposure to Asia-Pacific real estate typically to benefit from the populous region’s diverging core strategies on offer, delegates at Expo Real heard during a panel session moderated by IPE Real Assets news editor Razak Musah Baba.

Discussing the topic of inbound investment from Europe, the panelists – Rushabh Desai of Allianz Real Estate, KaiLong’s Hei Ming Cheng, Carsten Kebbedies of Nuveen Real Estate, Ng Chiang Ling of M&G Real Estate and Invesco Real Estate’s Calvin Chou – agreed there was growing appetite among European institutions for Asia-Pacific real estate.

Ng said M&G Real Estate has been investing in Asia since 2002 with foreign insurance and pension capital.

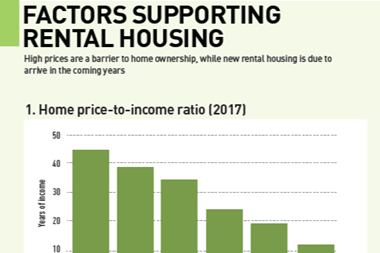

“Asia, as we all know, has a growing population, growing wealth,” the CEO said. “It is a market that is growing, a lot of infrastructure is being built and alongside it, clearly, real estate can benefit strongly from the momentum.”

Hei also said the first fund of Hong Kong-based KaiLong, which was raised in 2015, has around 25%, European investors.

“For fund two, which was double the size of the first, we have over 60% European investors,” he said adding that he’s seeing a lot of interest from European investors in countries like China.

Kebbedies said Asia-Pacific was for a long time a value-add opportunistic play, “but I think now we are moving on into the core space and that makes it easy for European investors, particularly German investors to move out to Asia-Pacific” – an assertion backed by Nuveen’s open-ended core property Asia-Pacific cities fund launched last year.

Chou said European institutions were foremost seeking for diversification, “as the markets within Asia behave differently”.

“Yes, first is diversification and there are two aspects to it”, Desai said. The first point is global diversification and the second is within the region, unlike Europe or the US.

Japan is different from Australia and China and India, so you are investing in a region which is in itself diverse, Desai said.

He said this provided level of “downside protection” because the “markets are not fully linked to each other”.

“On a risk-adjusted basis, I do feel Asia is attractive vis-à-vis the rest of the world because, as Chiang Ling mentioned, there’s secular growth in the region on a long-term basis.”

Desai said he believes that, in the next two to three decades, Asia-Pacific will make up 80% of the other largest cities and economies of the world.

“Having said that, we are a European-based insurance company, so we do have to have the largest portfolio in Europe,” he said. “We still feel that Asia as a diversification play is fairly attractive.”

Kebbedies said European investors can gain a meaningful core exposure today by way of investing in Asia Pacific despite the US being a much bigger and more established core market.

In Asia-Pacific, countries like Australia, Korean, Japan, Singapore and Hong Kong can be targeted for core, the managing director said.

Ng said because the core real estate market is still at its very early stage compared with the US, “we are planning and looking at ways to develop and manage to core”.

“Not easy to do, but we look at ways to structure cash flows around the physical building to help investors investing in funds that can provide stable durable cash flow,” she said

Chou said it is is very difficult across the world now to find value. “Japan is the market that we are very focused on; we particularly like where we are in the cycle for Japan, because it is still one of the highest positive spread.”

The managing director said Invesco takes a defensive stance to gain exposure in the region, in addition to accessing opportunities in the form of relationships.

“We feel very good about opportunities in Australia”, and where Australia sits in the demographics in relation to China and India, he said.

“We are asked if there’s really core product in China. To argue that you can invest in Asia and ignore China is pretty ridiculous…cities like Shanghai with 30 million people – that is more than all of Australia and six-times Singapore, so is it ok to invest in Singapore or Australia but it’s not ok to invest in a city with 30 million people with world-class infrastructure, growing businesses?”

“When we think about core we want liquidity, we want rule of law, how we can be comfortable with the income streams in the next 10 years…those are the tenets we look for in a core investment.”

Desai said it is a misnomer to think Asia is a place for high returns. To assume Tokyo will give you opportunistic returns compared to New York or London is a myth and that needs to be broken, the CEO said.

“I think Asia needs to be viewed as a place with secular growth and not necessarily a high-return strategy.”

Also, the definition of core and value-add is blurred and depends on leverage, he said. What is core in Japan is different from what is core in Singapore.

“What we think about is building a portfolio of what is income-producing on one hand and building a portfolio and balancing it with assets which are on a total-return basis.

“So China and India, for example, are a total return play. You are not going to get any yield out of that, whether its core or not. There’s a structural issue of getting money out of the country.

“Whereas when you are investing in Australia or Tokyo or Singapore, it’s more an income-producing play for investors, so that’s how we think about it, balancing income-producing and total-return strategies.”

A lot of people do not think China has core assets, but it depends on how you define core, Hei said.

“If it is defined as a trophy asset in a prime location then there won’t be much to invest in,” he said. “But if you are referring to core as income-producing then you do have a lot in China – like logistics.”