Previous downturns have historically presented attractive investment opportunities, with subsequent market recoveries driving strong returns, writes Peter Hobbs

The 2023-24 real estate correction is the fourth major dislocation of this asset class in the past 50 years.

The prior examples – the banking crisis of the early 1970s, the oversupply of the late-1980s/early-1990s and global financial crisis of 2007-09 – involved significant value decline and distress across many parts of the real estate market.

Each correction ended up providing a good opportunity for new investments in the asset class, with recovering markets driving strong performance.

But a good vintage does not guarantee good performance for all; there are key pitfalls to watch out for in each of the major real estate segments.

Throughout 2024, real estate managers have called on allocators to increase their exposure, highlighting the chance to “acquire assets at attractive prices” in today’s “fragmented market”.

Yet fundraising has remained subdued with capital raising for closed-end real estate funds in 2023 being at its lowest level since 2011, and the $66bn (€78bn) raised in Q1 and Q2 2024 being the lowest first-half for a decade, according to Preqin.

Moreover, as troubles in the real estate market persist, asset management firms are now coming under pressure due to decreased revenues and profitability.

Amid cost-cutting and re-prioritisation, investors in this asset class must consider the resilience and integrity of management platforms, teams and individuals.

These questions of corporate stability are always relevant but become particularly significant when investors are navigating periods of major dislocation and recovery; even a great investment team with a great strategy can run aground in choppy waters.

Learning from the past, each major real estate downturn echoes with the same rhythms, and this cycle is no exception – weak performance (down 20-30% in most markets), plummeting transaction activity (50% down on the prior year in 2023), high levels of redemption activity (many open-end funds with 20%+ redemption levels) and fundraising challenges.

Not all crises, or recoveries, are created equal. The 2023-24 correction has its own unique characteristics. This drawdown has itself been narrowly preceded by a substantial pandemic-driven slump.

Today’s interest rate environment and inflation conditions are dramatically different from those witnessed from 2009 onwards.

The current correction has involved significantly greater variation in the performance of different property sectors than we saw in 2007-09. Offices, for example, are particularly out of favour versus ‘next generation’ sectors such as medical offices and data centres.

This cycle also has a greater focus on ESG considerations, particularly in terms of the need for ESG/climate risk mitigation, which brings both costs and ‘stranded asset’ risks.

Despite these differences, real estate cycles do follow similar themes, so it is worth examining the most recent downturn, GFC [global financial crisis], to gain insights into how the market might move through the later stages of the current cycle.

Such insights can help in devising appropriate strategies and in avoiding some of the pitfalls that often exist at this stage of the cycle.

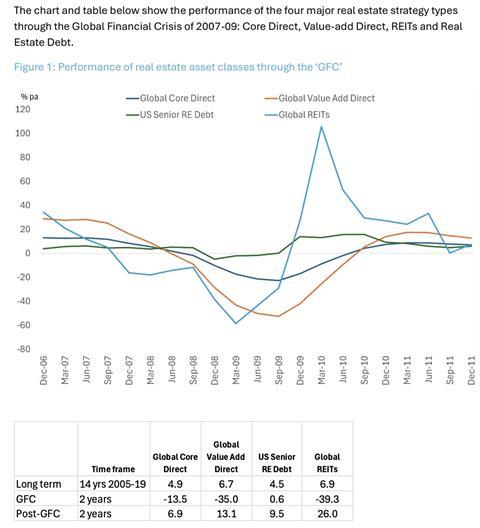

The overall pattern is broadly as one would expect with high volatility in REITs, resilience in debt and value-add performing more strongly and weakly than core at different points in the cycle. The data show the large direct and REIT drawdowns during the GFC, and the strong bounceback after the downturn.

The chart also shows how the REIT market moves ahead of the direct market, moving into the downturn and posting positive performance a full three quarters ahead of the direct market.

The current cycle shows a similar picture in many ways. Real estate debt is delivering healthy yields; even though 2024 base rates are higher than those of 2008, margins have remained broadly attractive.

REITs, which have endured very poor recent results, may benefit more quickly from potential rate reductions, while the recovery in core may well be later and slower, gradually in 2025 and beyond.

Although these trends support the case for 2024/25 being good vintages for investing in real estate, each of the main asset classes has significant potential pitfalls at this stage of the cycle.

Four asset classes: watch out for these recovery pitfalls

- Core real estate

Resilience to a weak fundraising climate: Investors should consider the strong possibility that aforementioned fundraising challenges persist over the medium term, and the implications for the viability of commingled funds in which they may wish to invest. There are structural factors that may continue to inhibit capital raising, such as corporate pension plan derisking in certain countries and the industry’s challenges in developing funds geared to retail investors – witness the reduction in fund sizes and even fund closures among property authorised investment funds. Not all managers and strategies are equally likely to experience fundraising disappointment, or equally vulnerable in terms of the implications that smaller raises may have for their strategy.

Redemption risks: For open-end funds, investors may still find sizeable redemption queues, raising questions of how new capital would be deployed alongside the need to provide liquidity to outgoing limited partners. Those without ongoing redemption pressure should also be scrutinised on how they managed to provide liquidity to investors through 2022-24, both in terms of the mechanics of redemption payments and from an overall portfolio positioning perspective – did they have to dispose of better quality assets to provide the necessary liquidity?

Diversification versus sector concentration: While it can be tempting to favour managers that delivered stronger exposure to sectors that proved more resistant in the latest (very sector-variable) drawdown, such as ‘next generation’ real estate, investors should weigh this appeal against the long-term merits of diversification. Some of these next generation sectors remain relatively expensive or others, such as self storage, are exposed to high levels of new supply.

- Value-add real estate

Eyes on existing assets: It can take two to four years to go through a capital-raising and investment period. As such, funds currently undertaking their later stages of capital raising are likely to have had their initial raise in 2022/23 and started deploying at this time, when valuations were higher than they are at present. Investors should take care when understanding the performance profile of any assets already acquired and the amount of dry powder that remains. Moreover, managers’ prior funds may be requiring considerable attention from the team, particularly if they are suffering from delays and write-downs associated with the current downturn. Will the key people involved in the current fund be distracted by the workload required for managing and working out legacy exposures?

Higher costs and the ESG imperative: Inflationary conditions have led to higher development costs in general. Investors may wish to pay particular attention to ESG considerations: climate-related requirements are ratcheting up, and the costs of refurbishment remain elevated. Does the manager have good experience of such activity and the elevated risks involved?

Operating partner relationships and complexity: As asset managers get more involved in those ‘next generation’ real estate sectors, the projects become more complicated than traditional bricks-and-mortar property. Operating partner relationships are evolving and demands on expertise are changing.

- Real estate debt

Resilience to a weak fundraising climate, again: There has been some disappointment on this score with Preqin data showing that real estate debt capital raising in 2023 was less than $5bn, only 6% of total private debt capital, compared with 20-25% of the total in the 10 years to end-2022. As noted above with respect to core, some funds here may fail to reach ‘critical mass’ for executing the strategy that they wish to pursue with an appropriate level of diversification. When interest rates do eventually decline, this may further affect the attractiveness of this asset class.

Changes in competitive conditions: The return of banks to real estate debt lending activity, which had been stymied, may drive compression in the yields that are realistically achievable in this sector. Asset managers may need to focus on more complex origination such as mezzanine, A/B notes and distress, as opposed to banking friendly parts of the market. The dynamics will be different in North America versus Europe, with the latter market being more nascent.

Corporate instability: As mentioned above, company and team stability should be watched with particular care during periods of dislocation and recovery. The real estate debt asset class may be particularly vulnerable due to the significant amount of corporate activity that has taken place in this sector over the past five years. Specifically, many real estate investment managers have built out capability on the debt side through acquiring boutique operators and integrating them with their real estate equity businesses or broader credit platforms. This makes sense from a long-term perspective, but businesses may be considering their strategic approach, given capital-raising challenges and cost-reduction pressures.

- REITs

Resilience amid the ‘trend to passive’: REIT platforms are under added pressure versus their real estate counterparts – the apparently inexorable move towards passive investing. Although data provides compelling evidence of alpha generation by active managers, passive REIT strategies have grown steadily – a cohort that includes semi-passive approaches with thematic or factor tilts. This trend, coupled with the overall disappointment of weak performance since 2020, has made it more challenging for asset managers to grow, develop and appropriately resource their REIT platforms. Investors may wish to focus on scale and robustness of managers’ platforms.

Struggling with low performance persistence: While data indicates strong alpha generation by active REIT managers as a group, there is not much persistence in the list of top-quartile performers. Investors should be cautious about favouring managers who have delivered stronger recent numbers, and look closely at the risks associated with particular levels of performance, through metrics such as tracking error, upside/downside capture, information ration and batting average.

Viability of new ESG/climate products: There has been a great deal of product development in the REITs sector focused on ESG, climate and ‘net zero’. Investors should examine these with care: they can involve a significant narrowing of the investment universe and carved out ‘track records’ will not necessarily be representative.

Beyond strategy: choosing the right implementation approach

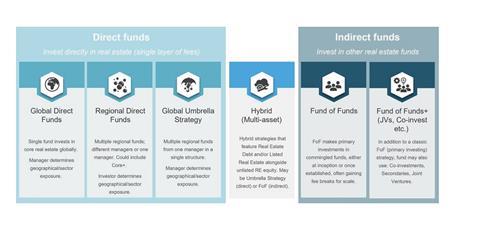

As a final point, it is worth noting that investors at this critical stage of the cycle – in addition to considering strategy-oriented points above – may also wish to re-evaluate the types of vehicle being employed.

Do current conditions make it more appropriate to consider a separately managed account versus commingled fund? Does the outsourcing element of fund-of-funds investment hold greater appeal today versus the use of single-manager funds? Are secondaries strategies particularly appropriate at this stage of the cycle?

There is a huge amount of choice available to allocators, in this respect. Indeed, the snapshot below illustrates the variety available purely in the world of global core real estate commingled funds. Preferences may evolve based on an investor’s internal dynamics (resources, governance, strategic shifts – eg, global versus domestic).

External considerations also affect decisions here, such as the change in the availability of different vehicle types.

Conclusion

If history repeats itself, now may be an opportune time for investors to dip their toes back into the real estate pond, with each market correction having historically offered a strong opportunity for new investment in the asset class.

Yet a good vintage does not always guarantee good performance. Investors must tread carefully when navigating through a recovering market and conduct rigorous due diligence when assessing new strategies and asset managers.

To read the latest IPE Real Assets magazine click here.