Prime London properties are in high demand among investors, who are drawn to their prestigious status and the perceived safety and stability of the market, writes Byron Baciocchi

Following a host of recent deals including GG Capital purchasing 9 Upper Grosvenor Street in Westminster for around £8m (€9.3m), and flexible office space provider IWG’s agreement to lease 73,000sqft of office space at One Olympia Building in Kensington, 2024 has started with a strong level of appetite amongst investors, operators and indeed tenants for commercial real estate in the right locations.

The heady cocktail of various economic factors including a period of high interest rates, challenging market conditions, and political uncertainty has caused short term doubt for some, however agile investors who can afford to play the long game are still moving forward with opportunities.

Research from BNP Paribas found that investment volumes in Central London’s office market reached £1.6bn in Q4 2023 – up 54% quarter-on-quarter as investor sentiment has significantly improved.

During the same period, prime office yields remained steady with West End achieving 4.00 – 4.25% and 5.75% in the City of London.

Leasing arrangements for Grade A offices accounted for 75% of all transactions in 2023, and demand from occupiers have increased West End rates to £150psf and the City stabilising at £75 per sqft. Furthermore, the research also suggests that West End super-prime office rents could double by the end of 2024, providing an excellent opportunity for active investors who are able to buy now.

The latest annual survey from RSM UK, which questions real estate professionals across the UK, revealed that 80% of respondents were optimistic about the sector over the next three years. Furthermore, respondents predicted that the value of UK commercial and residential property will increase by approximately 3.5% over the next 12 months.

The report also highlights that London is considered a safe haven and a globally resilient place to invest, with private equity and overseas investors attracted to the capital. Over 40% of all inbound investment flows into London.

So where is the money going? International and family office investors tend to remain focused on prime, well-established neighbourhoods in the capital, the type of areas you think of when thinking of ‘prestige’ - Kensington, Mayfair and Soho for example. From our own experience, it is prestige and therefore demand, security and stability that are driving decisions from investors.

Most recently, the opportunity to acquire and retrofit underperforming commercial real estate assets in London has become more prevalent. Research from FORE Partnership estimates that there are around 6,500 office buildings above 20,000 sq ft in London that are in urgent need of retrofit to achieve existing EPC regulations and meet London’s ambitious net zero goals.

Currently, around 1-1.5% of existing commercial buildings are being retrofitted, which is way below what is required to reach the UK’s 2050 goals. These figures need major improvement in the very near future, presenting a prime opportunity for savvy hands on investors to acquire, update and then attract the best occupiers.

Aligned with this, we kicked off 2024 with a strong start, growing our portfolio with the acquisition of 167-169 Wardour Street in Soho for £11.5m. Totalling 13,628 sq ft arranged over six floors, the building is fully let with a restaurant occupying the basement and ground floors, and office space on the remaining four floors.

Building on this, we are currently exploring nine further acquisitions, reflecting our confidence in the fundamentals of Prime Central London.

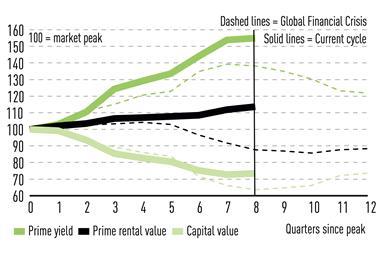

With occupier demand at an increasing high, interest rates dropping, loans being called in and distressed commercial assets coming to market, savvy investors who fully understand the potential challenges and hurdles they need to overcome, and the complete cycle, can thrive in current market conditions and take full advantage of the opportunities presented.

In short, investors actively involved in commercial real estate fully understand the challenges they face with new investments but the market is in a positive place and conditions will continue to improve. Now is the time to explore and execute investment strategies in Prime Central London. And with discounted assets coming to market, ensure you strike while the iron is hot.