Brookfield Asset Management’s infrastructure arm and Singapore’s sovereign wealth fund GIC have partnered to buy North American rail firm Genesee & Wyoming (G&W) for $8.4bn (€7.4bn) including debt.

In a joint statement, the parties said Brookfield Infrastructure and GIC will offer $112 for each G&W share.

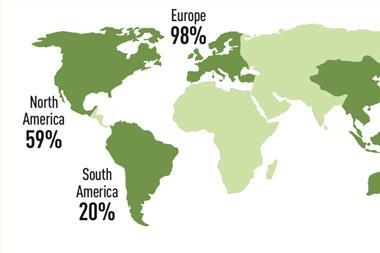

G&W owns a portfolio of 120 short line railroads, predominantly in North America, with operations in Europe and Australia.

Jack Hellmann, G&W chairman and CEO said the sale price represents a 39.5% premium to the company’s share price on 8 March, the day prior to initial media speculation of a potential transaction.

“And for long-term investors who have owned our shares for the past two decades, the sale price represents a return of more than 5,400%.

“For our customers, employees, and class I partners, the long-term investment horizon of Brookfield Infrastructure and GIC as seasoned infrastructure investors is perfectly aligned with the long lives of G&W railroad assets, which are integral to the local economies that we serve in North America and around the world.”

Sam Pollock, CEO of Brookfield Infrastructure, said: “This is a rare opportunity to acquire a large-scale transport infrastructure business in North America.

“G&W will be a significant addition to our global rail platform and will expand our presence in this sector to four continents.

Ang Eng Seng, CIO for infrastructure at GIC, said, “As a long-term investor, GIC is confident G&W will continue to generate steady profitability, given its diversified operations and customer base.

“We look forward to partnering with G&W’s management and Brookfield Infrastructure to support the future growth of the company.”

The transaction, which is expected to close by end of this year or early 2020, is subject G&W shareholders and competition approvals.