Australia’s Cromwell Property Group is planning to launch a €500m European real estate fund, a year after buying Valad Europe.

CEO Paul Weightman told IPE Real Estate that plans are well advanced and a launch is expected in the next few months.

Cromwell was one of the first Australian real estate fund managers to re-enter Europe when it bought pan-European real estate manager Valad Europe for €150m from a fund managed by Blackstone.

The new fund will make use of the European platform to tap into a desire among Australian and other global investors to gain access to European real estate markets.

“There is a lot of capital available – and a lot of interest – from global investors for investment in Europe,” Weightman said. “We’ve noticed a shift from private equity into core-plus and value-add funds.”

Initially, Cromwell, whose single largest shareholder is South African company Redefine Properties, expects to raise capital from Australian and South African investors for the European fund.

The company recently appointed Bevan Towning, a veteran property funds manager, to head its Australasian wholesale unlisted funds management division and to target Australian and Asian capital for investment in Australia and Europe.

The listed company announced its latest six-month results this week and Weightman told analysts and investors: “We have a competitive advantage that is difficult to replicate in a market of Europe’s size and complexity.”

Weightman told IPE Real Estate that the days when investors could make money easily buying distressed assets and adding value to these assets were over. “To get the right returns, investors are turning to managers with good old-fashioned asset management skills,” he said.

Weightman said Cromwell’s European business now has 23 offices spread across 15 countries.

“We are proceeding with operational integration across our international (European) platform, and we are developing a common brand strategy,” he said.

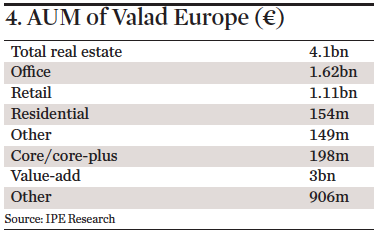

Valad Europe manages more than €5bn in real estate assets through a number of funds and 20 single mandates.

Weightman said Cromwells’ Valad Netherlands Diversified Partnership, launched last year, has now invested €325m of its €500m of capital.

It has also extended the life of the Valad European Income Fund for three years after completing a €200m refinancing.

Cromwell had almost A$9.8bn under management, more than half of that in Europe, at the end of 2015. It announced operating profits of A$88.8m – up 22% on the corresponding first half in the previous financial year – reflecting the first full six months contribution from its European funds management business.