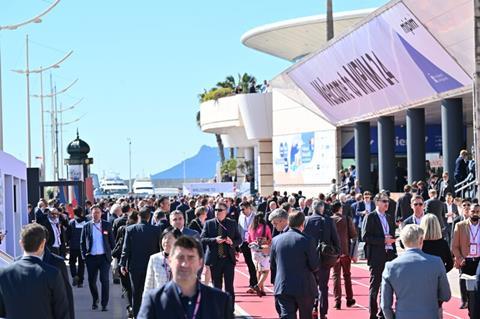

Last year, the mood at MIPIM was nervy. Silicon Valley Bank in the US had collapsed and what seemed to be an emerging banking crisis spread to Europe, precipitating the rescue of Credit Suisse. A year later and the sentiment at the annual real estate gathering in Cannes was more positive, but still uncertain.

On the Monday afternoon, more than 50 institutional investors, including pension funds, sovereign wealth funds and insurance companies, reconvened for the annual, closed-door RE-Invest summit (see box below for the organisations present). At a number of concurrent roundtables they were able to talk openly about the issues really exercising their minds, or as it was themed: ‘What is keeping you awake at night?’

The common expectation was for interest rates to begin to fall this year and transactional activity to return to something like normal levels in the second half. But will rates come down quickly enough? And wasn’t the same prediction about deal activity made last year?

As well as ongoing concerns about valuation uncertainty, the withdrawal of bank finance and obsolescence in the office market, there was an acknowledgement that investors probably need to factor political risk into their real estate allocations more so than they have done in the past. With inflation, a cost-of-living crisis and a growing unaffordability in cities, investors face increasingly unpredictable rental regulations – precisely at a time when many are looking to reweight their portfolios away from office and retail to the living sector.

But there was another, more surprising, recurring theme. A word kept turning up in conversations and it was one not normally heard at MIPIM: infrastructure. With the recent rise in interest rates, real estate finds itself facing greater competition from fixed income, but it is also vying for capital with other alternative asset classes.

Both real estate and infrastructure benefitted from the recent decade-long period of low interest rates, with the alternatives slice of institutional allocations growing bigger as investors went on a widespread hunt for yield. But while 2023 was a difficult year for real estate in terms of repricing, returns, transactions and fundraising, infrastructure did not seem to suffer to the same extent. Infrastructure had been a newer asset class relative to real estate, but during that lower-for-longer period it has grown and become more mature and sophisticated. The ‘new kid on the block’, has come of age was the consensus in Cannes.

On the Wednesday morning, INREV held its annual MIPIM seminar and sought to address the question how attractive real estate was in this new phase. To provide a broader perspective on asset allocation, the European real estate association invited Vera Fehling, CIO for Western Europe and head of liability-driven investment at DWS, who was able to talk about the performance of different asset classes for clients and how pension funds might allocate going forward.

Fehling had some good news. After a year of poor performance in 2023, this was likely to “be a very good vintage year” to begin committing capital to real estate, especially considering DWS’s central expectation that the European Central Bank and US Federal Reserve will in June start to make the first of three interest-rate cuts this year. However, on further audience questioning she went on to say that infrastructure was a “very hot topic” among investors, especially in the area of energy transition and that many clients had much lower exposure to infrastructure versus real estate, making it easier to allocate more capital to the former.

During a panel discussion that followed, Annes Gales, co-founder and partner of Threadmark, who has been advising on capital raising for both asset classes, said infrastructure was growing fast. “Right now we see a shift for sure,” she said. “I think it’s a very interesting time to be talking about this.”

But there could be even more important shifts on the horizon. On Tuesday, Konrad Finkenzeller, head of global client solutions at Patrizia, offered an interesting prediction. In the next four to five years, investors’ real estate and infrastructure allocations will merge, he told IPE Real Assets as the overlap between the two becomes harder to reconcile.

Today, real estate and infrastructure investors and fund managers are increasingly looking to acquire the same assets – the obvious examples being data centres, student housing and healthcare property. But while both sets of investors are increasingly looking at the same assets, they can be doing so with different costs of capital, with infrastructure fund managers having longer-term and potentially lower return hurdles. This could create opportunities for real estate investors to sell certain real estate investments to these lower-cost sources of capital, Gales said.

One of the biggest reasons infrastructure seems to be in the ascendancy is that it is currently offering investors a way to participate directly in one of the biggest investment theses of the day: the energy transition. Funds targeting renewables, energy storage and other assets and technologies supporting the global move to clean energy have been raising billions in dollars from institutional investors.

Infrastructure as an asset class has a strong story today, said Finkenzeller, and when pension fund CIOs look at their alternatives allocations, which have grown to become 30% of portfolios today, they are invariably looking for compelling investment narratives.

Perhaps real estate needs to up its game and be more communicative with its own story. During the INREV panel session, Finkenzeller’s colleague, Mahdi Mokrane, head of investment strategy and research at Patrizia, wondered whether the industry needed to better “present ourselves to allocators”.

Like infrastructure, real estate has a major part to play in decarbonising the built environment. But of equal importance is its potential role in addressing the global housing crisis and its ability to make positive social impact in a tangible way. “This is where we need to change the narrative around what we’re doing to real estate to address society’s needs,” Mokrane said.

The comments came a week after Europe’s largest pension fund, the Dutch civil service scheme ABP, pledged to invest €30bn in social impact investments by the end of the decade, including committing €5bn to building additional affordable housing in the Netherlands.

There is a huge undersupply of affordable housing in cities across the world, but development is often held back by planning systems, higher construction costs and the respective financial requirements of investors, developers and municipalities. ABP’s pledge, which includes social return objectives alongside financial ones, could help open up this impasse and set a blueprint for other institutional investors to follow suit.

Investors at the RE-Invest summit were very keen on gaining more exposure to residential markets, but were finding it difficult to invest, especially with increasingly unpredictable regulations affecting the markets.

Global residential specialist fund manager Greystar has been expanding its European platform over the past decade. Mark Allnutt, executive director, who leads the business in the region, told IPE Real Assets that the chronic undersupply in for-rent residential – especially in the student housing in sector – meant the fundamentals for living real estate were undeniably strong. Rising inflation and new regulations had produced challenges for the sector, but the situation was effectively “settling down”, he said.

Furthermore, new innovations and practices in developing housing assets were on the rise, including modular housing, which allow for construction offsite at lower costs. The rise of alternative intelligence (AI) technology would also accelerate innovation and trends in the residential sector, Allnutt said. Greystar is looking at how AI can help further harness the growing pools of data the firm has on factors such as rental growth, demographics and yields across a portfolio that serves on any day more than three million customers.

AI is expected to disrupt a whole range of areas of the real estate industry, not least the office sector. Andy Pyle, head of UK real estate at KPMG, told investors at the RE-Invest summit that AI was likely to accelerate and exacerbate the effects of working from home and the bifurcation and obsolescence playing out in office markets. It is likely to help companies scale back and use commercial space even more efficiently.

The bifurcation of the office market is well known now and there are clear investment opportunities for delivering the best quality, cutting-edge and sustainable commercial space in key locations. James Boadle, senior vice president at Oxford Properties, said the real estate investor would be looking out for opportunities to enter the sector after being a net seller of offices in recent years – a well timed move by the business, which is owned by Canadian pension fund OMERS.

The office sector has changed, characterised by shorter leases and requiring more operational, customer-focused capabilities. Oxford Properties, which has made big inroads into the specialised sector of life-sciences real estate in recent years, would be in a position to navigate office investment opportunities as they emerged, Boadle told IPE Real Assets.

But even here Finkenzeller is concerned about the effect that technology and AI will have on the sector. Yes, the best quality stock should perform well in the next five years, but the most interesting point will be after that, he suggested.

With leases becoming ever shorter and the pace of technological change increasing, will the cycle of obsolescence itself speed up? How relevant will today’s cutting-edge buildings be in five years’ time?

RE-Invest summit: investors in attendance

- ADIA (UAE)

- ADIC (UAE)

- AIMCo (Canada)

- APG (Netherlands)

- Aware Super (Australia)

- BVK (Germany)

- Bouwinvest (Netherlands)

- CNP Assurances (France)

- CPP Investments (Canada)

- GIC (Singapore)

- HOOPP (Canada)

- ICD (UAE)

- Ivanhoé Cambridge (Canada)

- KIC (South Korea)

- KLP (Norway)

- OIA (Oman)

- Ontario Teachers’ Pension Plan (Canada)

- PFA Pension (Denmark)

- PGGM (Netherlands)

- PSP Investments (Canada)

- QIA (Qatar)

- QuadReal (Canada)

- Teacher Retirement System of Texas (US)

- Temasek (Singapore)

- Zurich Insurance (Switzerland)