UK local authority pension funds are seeking global real estate exposure. Martin Gilbert and Andrea White explore the rationale and the timing

There is no denying that the last few years has been a challenging time for the UK property market. Multiple externalities have combined at a time when real estate is already having to deal with the twin challenges of technological disruption and environmental regulation.

The effects on UK all-property total returns have been notable, the volatility in annual performance has increased and we have seen increasingly divergent performance on a sector and asset level. Over the five years to December 2023, UK property total returns have averaged 0.8% pa, with total returns ranging from a high of 7.3% pa for industrial to a low of -3.6% pa for retail.

Office rental values are about 10-20% ahead of their 2008 levels in the UK

The medium-term outlook for UK real estate is more promising. The broad-based repricing in asset values that was fuelled by the Bank of England’s interest rate hikes is nearing an end, and with inflationary pressures easing and monetary policy conditions expected to become more accommodative, a modest recovery in capital returns and stronger total returns are anticipated from 2025. DTZ Investors is forecasting total returns of about 6% pa from UK property over the next five years. London industrial, convenience retail and the living sectors look most attractive, with 2025-26 expected to be particularly strong years.

While this represents a healthy return in comparison to recent years, domestic investors – notably local government pension schemes (LGPS) – are seeking non-domestic exposure to sit alongside their UK assets. Fuelled by the greater firepower afforded to them through investment pooling, LGPS are finding they can achieve sufficient scale in their UK portfolios, so they are increasingly looking to diversify risk and return through non-domestic investment in real estate. What does non-domestic exposure offer and is now a good time to get it?

Diversification benefits

Real estate supply and demand are heavily influenced by local regulatory, tax and planning frameworks and regional socio-economic and political environments. Thanks to these factors, international real estate markets are likely to continue to move asymmetrically, just as they have done in the past.

“The UK has corrected faster than other global markets to tighter monetary policy conditions”

Low or negative correlations between some real estate markets mean that global portfolios can potentially benefit from a powerful diversification effect through an improvement in risk-return profile.

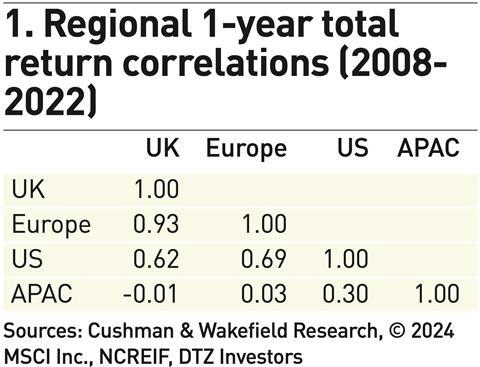

Adding assets to a diversified portfolio that have correlations of less than one with each other can decrease portfolio risk without sacrificing return. Past performance has shown that real estate investments in Asia-Pacific have provided the best diversification benefits to UK real estate (Figure 1). At -0.01, Asia-Pacific has displayed the weakest correlation to the UK over the past 15 years. But due to closer trade links and similar monetary policies Europe and the US are more closely aligned.

Figure 2 highlights this point further. The chart displays the annual all-property total returns delivered by the UK, continental European, Asian, US and global real estate markets since 2008. As shown, real estate returns have been less volatile in Asia-Pacific, and performance peaks and troughs have generally occurred in different time periods.

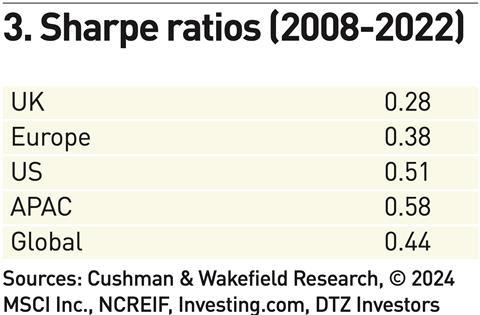

The Sharpe ratio is a measure for calculating risk-adjusted return and is the average return earned in excess of the risk-free rate per unit of volatility or risk. The greater the value of the Sharpe ratio, the better the risk-adjusted return. As shown in figure 3, an investor investing exclusively in the UK since 2008 would have experienced a Sharpe ratio of 0.28. By expanding the investible universe to include the wider European, US and Asian markets, an investor could have increased their Sharpe ratio and achieved a better return on a risk-adjusted basis over the past 15 years.

Rental growth potential

The inability of developers to perfectly react to changes in demand causes cyclicality in real estate markets. During periods of expansion, rising occupier demand is not met by a corresponding increase in supply due to the time it takes developers to obtain planning permission and build new stock. In response to increasing rents caused by the supply-demand imbalance, developers significantly increase their activity. Historically, the supply pipeline tends to overshoot at the market peak and then follows a period of contraction as the glut of space is slowly let up. This has been mitigated somewhat in the current cycle as spiralling construction costs have limited any overshoot.

However, the development tap is still consequently turned off as rents soften and so the market recovers before the cycle starts again. This natural ebb and flow to international real estate markets offers investors with a global investment remit the opportunity to target those markets in a growth phase and avoid those in a state of decline.

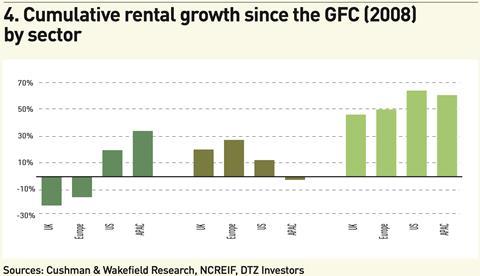

As figure 4 shows, the growth in rental values by sector since the global financial crisis in 2008 has varied by sector and location. All regions have seen a significant recovery in industrial rental values, with growth exceeding 40% since 2008. Office rental values are about 10-20% ahead of their 2008 levels in the UK, continental Europe and the US, but have only just reached their 2008 level in Asia-Pacific. Whereas the recovery in retail rental values has been mixed, the US and Asia have produced strong rental growth, exceeding 20%, while rental values in the UK and continental Europe are 20% below their 2008 levels.

The differences in sector rental growth rates by region are not only attributed to the fundamentals (demand-supply dynamics) of the local market but can also be explained by the maturity of the real estate markets, and the speed at which these markets can respond to wider macroeconomic events, one-off disruptive events such as COVID-19 lockdowns and other structural forces (technological advance and demographic shifts).

On this basis, investors may be able to take advantage of late-cycle growth opportunities by investing in economies that are further behind the UK in terms of their economic and real estate recovery. To determine whether these opportunities are available, it is worth assessing the rental growth prospects of each region in more detail.

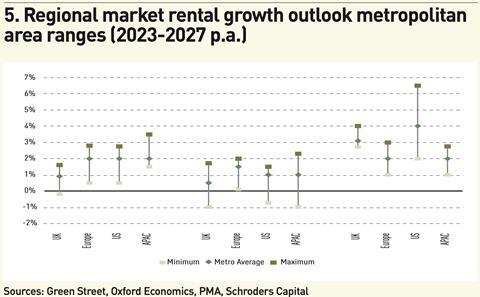

Figure 5 shows the five-year rental growth outlook for the major sectors for each region as well as the range in growth rates across key metropolitan areas. The forecasts suggest that some gains could be made through non-domestic investing, with slightly better rental growth expected for the retail and office markets outside of the UK. Whereas in the industrial sector, only the US is expected to deliver stronger rental growth than the UK. With such sector variance globally, a more macro approach to strategy is required.

With the UK accounting for 11% of the global real estate universe, as measured by MSCI, and forecast total returns expected to be modest, can domestic investors afford to ignore non-domestic opportunities?

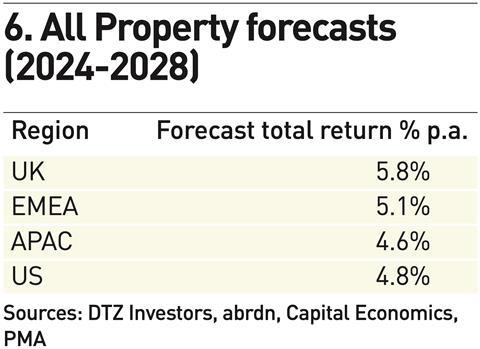

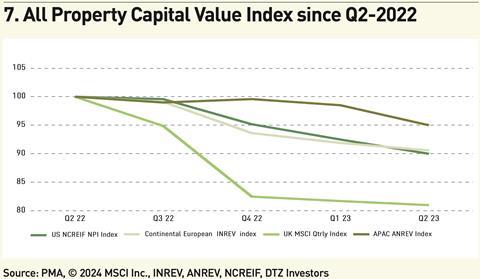

Figure 6 shows how the UK’s real estate prospects fare relative to other real estate markets globally. Interestingly, despite better rental growth projections for some of the international markets, the five-year outlook is muted across all regions, with forecast total returns ranging from 4.6% to 5.8% pa and the UK ranking at the top end of that range. This is hardly surprising. As can be seen in figure 7, the UK has corrected faster than other global markets to tighter monetary policy conditions and should therefore expected to see an earlier recovery in performance.

With further modest declines in prices left to play out across non-domestic real estate markets, a wait-and-see approach might feel like an appropriate strategy, especially as there is still talk of a US recession in 2024 and the Asian real estate markets being held back by the economic slowdown in China. But while the headline figures suggest prospects for non-domestic markets do not look as compelling as the UK, there will inevitably be differentiation in performance with some segments delivering better returns than the average and some worse. The key is defining a strategy that over the long run achieves both performance and diversification objectives. Alignment with specialist managers that have local market presence will be a key success factor, whether execution of the strategy is through direct or indirect investment. It is not enough to invest in a global fund vehicle and hope for the best.

Martin Gilbert is head of indirect investment and Andrea White is strategy director at DTZ Investors