Three large Dutch pension funds have made a combined investment of €275m in the Dutch Prime Retail Fund (DPRF) run by insurer and asset manager ASR.

The €25bn scheme for private road transport (Vervoer), the €20.3bn pension fund for the retail sector (Detailhandel) and the €5.3bn APF, the Dutch scheme of chemical company Akzo Nobel, have joined 10 other investors in the €1.5bn fund.

DPFR is a closed-end fund with an unlimited life duration and targets high street, shopping centres and supermarkets.

The investment fund has more than 200 shops in the Netherlands, with more than three-quarters located in the Randstad area and 95% of the high street portfolio positioned in the country’s top 20 most popular shopping towns, said ASR.

Fund director Edwin van de Woestijne claimed that the retail fund was the “most core” in the Netherlands, adding that the vacancy rate was no more than 2% and leverage level of the fund was 11%.

Speaking to Dutch financial newspaper FD, he noted that the downward trend in retail rents during the past few years had been reversed.

Competition for the best properties had become fierce, which had raised prices and suppressed returns, he added.

“It is not always attractive to buy a property at the best locations in Amsterdam or Utrecht, but we still can acquire retail objects against a decent return and attractive risk in towns like Zwolle, Haarlem and Den Bosch,” the FD quoted him as saying.

However, Van de Woestijne emphasised that his fund didn’t feel pressured to invest.

A spokeswoman for ASR added that the retail fund had returned 7.2% last year.

ASR said it would keep a significant stake for the long term in the retail portfolio.

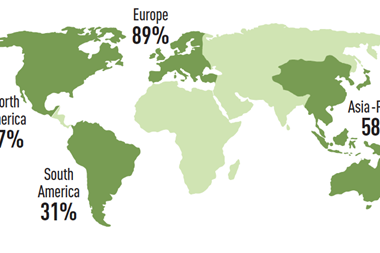

The spokeswoman said that stakeholders also included pension funds and asset managers from Belgium, France, Switzerland and the UK, as well as Asia. She declined to provide further details.