California State Teachers Retirement System (CalSTRS) has approved a $875m (€773.7m) commitment into three real estate strategies.

CalSTRS is putting $400m into a joint venture relationship with Beacon Capital Management known as BCal II, $350m into a managed account relationship with Fortress real estate vehicle FRO MA I and $175m into Tristan Capital Partners’ Curzon Capital Partners 5 Long-Life value-add fund.

BCal II will be investing in core US office buildings. CalSTRS owns a 95% interest in the joint venture.

The FRO MA I managed account will target opportunistic real estate assets.

CalSTRS said backing the open-ended Tristan Capital fund will give the $229.2bn pension fund more liquidity and flexibility with its real estate commitment.

CalSTRS will be putting this commitment into the value-add sector of its $31.4bn real estate portfolio.

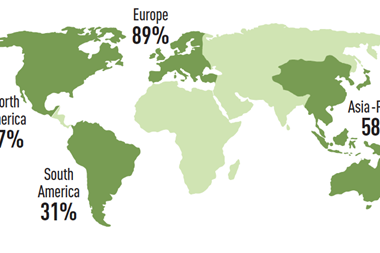

The 5 Long-Life fund will have a light value-add investment strategy. The fund will target office, logistics, retail and residential assets in Western and central Europe.

No comments yet